Background

- An unfavorable status of the United Arab Emirates (UAE) before the European Union (EU)

- Pro-active measures to address EU concerns around shifting of profits aimed at the following key factors:

- No or nominal taxes;

- Lack of transparency and exchange of information; and

- Lack of substance requirements

- UAE’s commitment as a member of the OECD Inclusive Framework

on BEPS

* Economic Substance rules bring specific requirements for UAE businesses to demonstrate actual economic activity in UAE

* Can form a basis to support that incorporation/ investment in UAE was not driven solely to benefit from a privileged tax regime

- Consequent to commitments, Economic Substance Regulations (ESR) vide Cabinet of Ministers Resolution No 31 of 2019 were released with effect from 30 April 2019

- Directives for implementation of ESR vide Ministerial Decision No 215 of 2019 were released with effect from 11 September 2019

- Determination of Regulatory Authorities vide Cabinet Resolution No. 58 of 2019 were released

Purpose of ESR

To ensure that entities registered in UAE (having commercial License, certificate of incorporation and any other form of permit issued by relevant authorities in UAE) that undertake certain activities are not used to artificially attract profits that are not commensurate with the economic activity undertaken in the UAE

Economic Substance (ES) Law in a nutshell

Structure of ES Law

Article |

Provision |

1 |

Definitions |

2 |

Objective of the Resolution |

3 |

Scope of application of the Resolution |

4 |

Meaning of Relevant Activities and Regulatory Authority |

5 |

Core Income Generating Activities in UAE per Relevant Activity |

6 |

Criteria to meet Economic Substance test |

7 |

Powers of Regulatory Authority to assess in respect of Economic Substance |

8 |

Reporting requirements |

9 |

Exchange of information with competent authorities |

10 to14 |

Penalties and appeals |

15 |

Power of Regulatory Authority to enforce Economic Substance |

16 to 19 |

Miscellaneous and administrative |

ES Law in a nutshell

ES Law does not apply to UAE Companies owned directly/ indirectly by any UAE Government or Government body

Structure of Directives for implementation of ESR

Article |

Provision |

1 |

Definitions |

2 |

Overview of Guidance |

3 |

Licensees required to meet the Economic Substance test |

4 |

Economic Substance Test |

5 |

Sector-specific guidance |

6 |

Regulatory Authority functions |

Relevant Activities

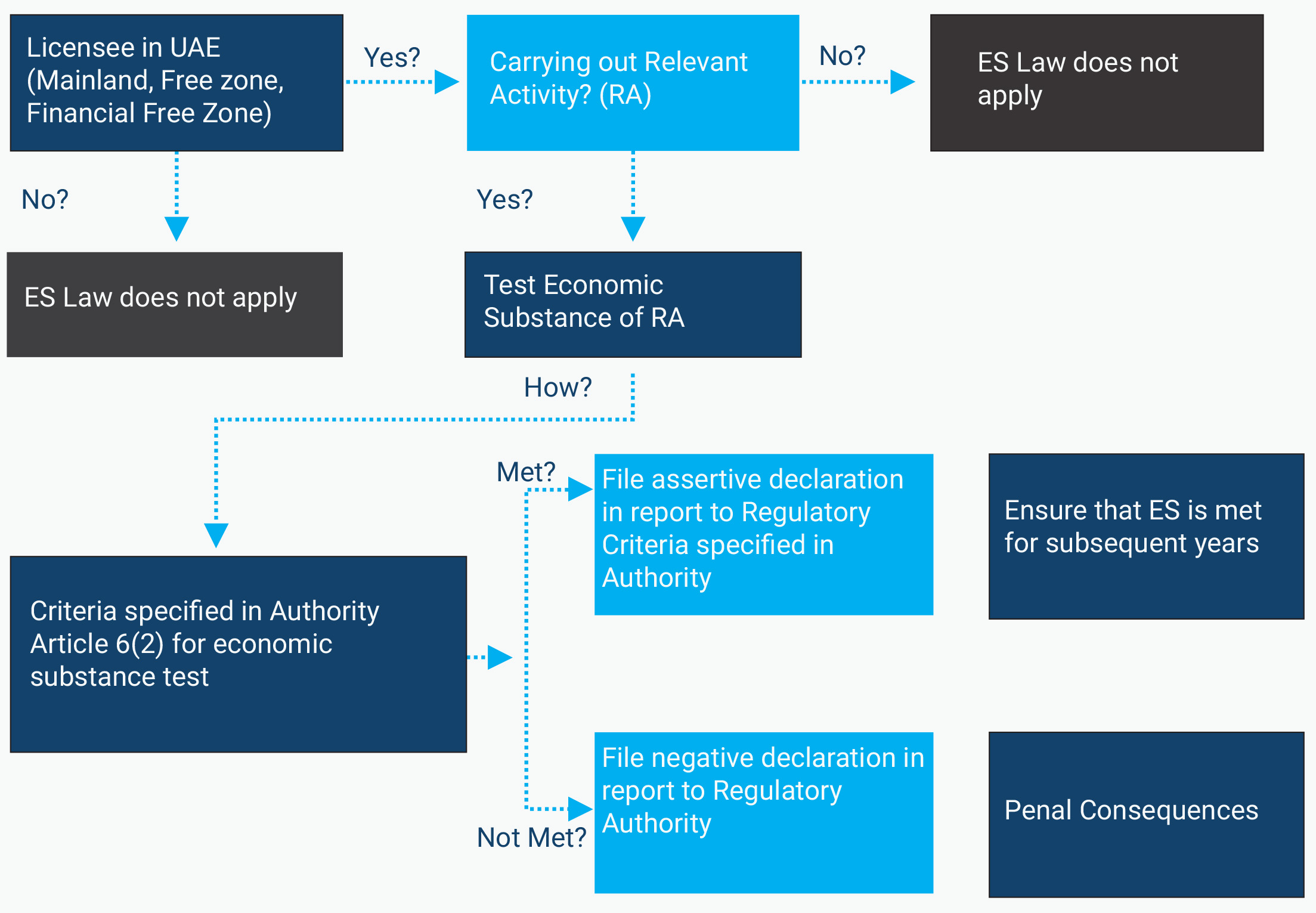

The economic substance regulations applies to covered UAE licensees engaged in RA

- Banking – Raising funds, managing risks, providing loans, etc

- Insurance – insuring or reinsuring, risk calculation

- Fund Management – investment decisions

- Financing & Leasing

- Holding Company (deriving income other than dividends and capital gains) – Activities associated with the type of income generated

- Distribution & Service Centre

- Intellectual Property – Branding, marketing and distribution

- Headquarter – Management, coordinating group activities

- Shipping (Marine) – Managing crew and ship maintenance

Distribution & Service Centre

- Purchasing from a Foreign Connected Person and importing and storing in UAE

- Providing services to Foreign Connected Persons in connection with a business outside UAE

D&SC Core Income-Generating Activities:

- Transporting and storing component parts, materials or goods ready for sale

Managing inventories - Taking orders

- Providing consulting or other administrative services

Foreign Connected Person:

Connected Person that is not a resident or deemed as resident in UAE

Economic Substance Test criteria

Areas to check for Economic Substance Test:

- Management: Companies in UAE must be “adequately” managed and directed from the UAE;

- Income: Income generating activity related to the RA should be undertaken in the UAE. It is pertinent to note that the list of Core Income Generating Activities as per Article 5 of ES Law (CIGA) are inclusive in nature; and

- Other administrative aspects:

- Adequate number of qualified employees

- Adequate physical assets

- Annual expenditure in the UAE

ESR reporting applicable for

The Regulations apply to financial years starting on or after 1 January 2019

Financial Year |

First assessable period |

January 2019 - December 2019 |

January 2019 - December 2019 |

April 2019 - March 2020 |

April 2019 - March 2020 *ES reporting for the period from January 2019 - March 2019 not required |

Reporting process

- Report whether the UAE company satisfies the Economic Substance Test must be submitted with the assigned Regulatory Authority

- The Economic Substance report must be submitted with the specified Regulatory Authority within 12 months after the end of the financial year. The first such report is therefore due on 31 December 2020

- Regulatory Authority will then submit a report to the competent authority i.e. the UAE Ministry of Finance and may be shared with competent authorities of overseas jurisdictions

Penal Consequences and right to appeal

- Failure to meet economic substance in UAE:

- Financial year 1 – AED 10,000 – 50,000

- Subsequent financial years AED 50,000 – 3,00,000

- Administrative penalty of AED 10,000 – 50,000 for failure to provide information or furnishing inaccurate information

All covered UAE businesses have the right to appeal against liability for administrative penal consequences and the amount of penalty – To be detailed in a resolution to be released by the UAE Government

Key contents of the ES Report

- Value and type of income and operating expenses related to each RA;

- Location of the business and physical assets deployed to conduct the RA;

- Number of employees, their qualifications and the number of people responsible for conducting the Relevant Activity;

- Evidence that decision making takes place within UAE;

- Ownership related details;

- Special information with regard to intellectual property; and

- Declaration stating that the corporate has met the economic substance requirements.

Relevant Authorities

Relevant Activity |

Regulatory Authority* |

Banking |

UAE Central Bank |

Insurance |

Insurance Authority |

Investment Fund Management |

Securities and Commodities Authority |

Lease Finance |

UAE Central Bank |

Headquarters |

Ministry of Economy |

Holding Company |

Ministry of Economy |

Shipping |

Ministry of Economy |

Distribution and Service Centre |

Ministry of Economy |

Intellectual Property |

Ministry of Economy |

* Free zone/ Financial Free Zone authorities are also Regulatory Authority(ies) for all Relevant Activity(ies)

Powers of Regulatory Authorities

- Authorities given the power to initiate audits 6 years from the end of the FY in which the report is filed – details and records to be maintained over the said period

- Authorities given the Power to Enter Business Premises and Examine Business Documents – requirements of prior notice for entering not mentioned – surprise checks may require ongoing compliance

- Regulatory Authority may suspend, revoke, or refuse the renewal of the License – could lead to major business disruption

Points to Ponder

Economic Substance Test determining factors:

- Outsourcing of RA: Level of controls and supervision of outsourced activity needs to be checked

- Branches, representative offices which do not have a board must ensure that manager/director is physically present in the UAE during decisions concerning administration or operation

- Companies which carry out intellectual property related activities are subject to additional obligations

- Holding companies are subject to less extensive requirements and may satisfy the economic substance requirements if they fulfil the requirements for the submission of data and information to the competent authority, and if they have sufficient staff and premises to carry out the work of a holding company.

Did You Know?

Aspect |

Answer |

Is reporting requirement there in case there is no RA? |

No requirement for that FY |

Is reporting requirement there in case there is no income from RA? |

No requirement for that FY |

If all income from the RA is earned from outside UAE, is the licensee exempt from the Regulations? |

No, this Licensee is not exempt from the regulations |

Is lending to another group entity considered a Lease-Finance Business? |

Yes |

Is investing and trading in debt securities considered undertaking a Lease-Finance Business? |

No |

Way forward…..

Businesses in UAE should:

- Internal review: Review documents/ contracts/ financials;

- Check for RA: Assess whether the business is engaged in any relevant activity. If so, conduct an analysis whether it meets or will reasonably meet economic substance criteria for a financial year and subsequent financial years;

- Impact assessment: Identify gaps and conduct impact assessment of the Regulations on its business;

- Decision making: Take remedial measures either through process changes or business restructuring; and

- Compliance: Understand the reporting requirements and ensure compliance

Note: Further guidance is respect of Economic Substance Regulations.