Business Opportunities: Union Budget

- Domestic Defence Production Units: DRDO to provide technology – Rs. 200,000 crore opportunity.

- A special concessional income tax rate of 15% for new manufacturing companies set up before 31st March, 2024.

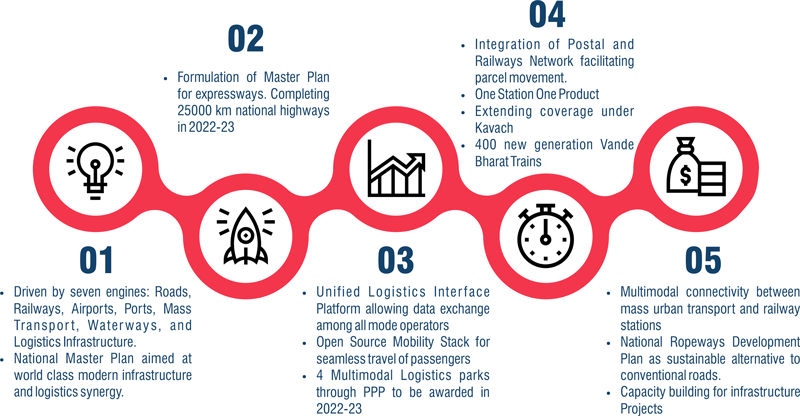

- To set up waterways and logistic support system – take advantage of GATI SHAKTI.

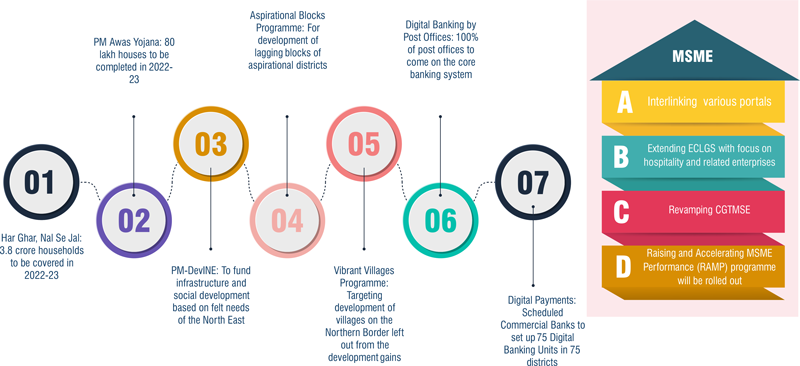

- Infrastructure – Road development and construction entities – 250000 km. new roads in 2022-23. Water connection to 3.85 crore household in 2022-23. Business units can take contracts.

- MSME to collaborate with Indian railways for development offers around 100 percent Railway stations.

- Funding – Emergency credit line increased to Rs. 3 lakh crore – special fund of Rs 50000 crores to hospitality hotels and related sectors. – Govt to guarantee loans given to MSME upto Rs. 2, 00,000 crore to enable collateral free borrowing.

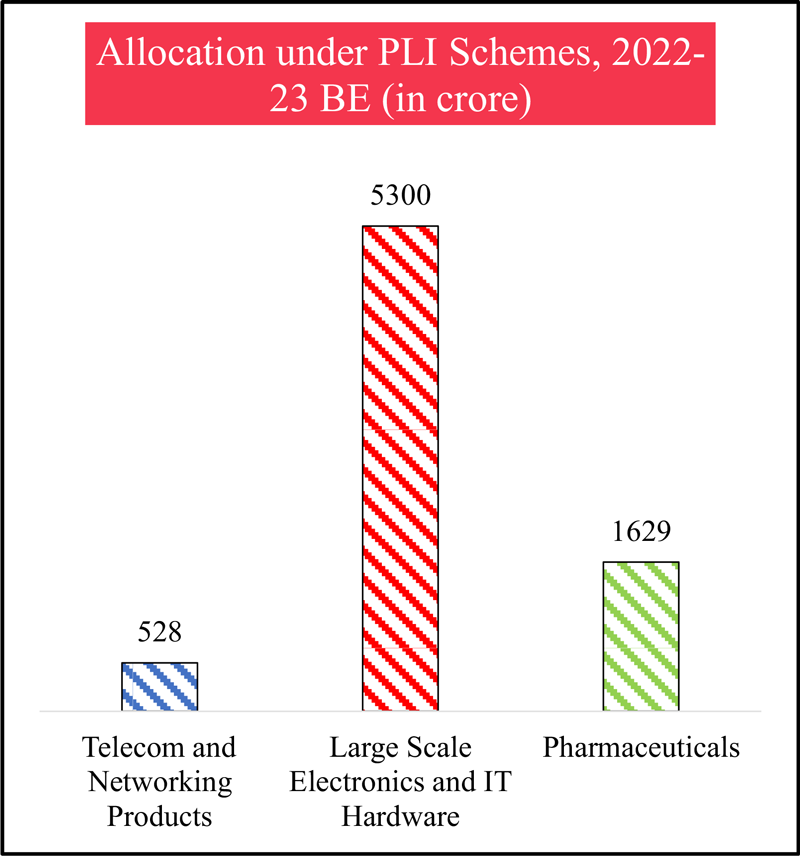

- Production linked incentive – 5% of sales value to be grant given by govt of India in 14 select sectors. A new 15th sector announced with Rs 19500 crore grants to set up manufacturing of Silicon to Solar PV high efficiency any modules all stages.

- No bank guarantee needed – Surety Band is enough – for all contracts as well as Gold Import.

- Central Govt and state government to make capital expenditure of Rs 10.68 lakh crores during 2022-23 – huge opportunity to take contracts of supply, logistics, installations, trading, sourcing.

- Environment – pollution treatment and solutions to be supported by govt by Green Sovereign Bands – money to be raised by govt of India – investment, broking and utilisation opportunity.

- Data centres and energy storage- recognised as industry for priority funding

- 100 percent villages to be linked to optical fibre connections – contracts for supply, laying and installing opportunity.

- International Arbitration centre at Gift City, Ahmedabad.

Overview of Indian Economy

Key Features

GOALS OF AMRIT KAAL

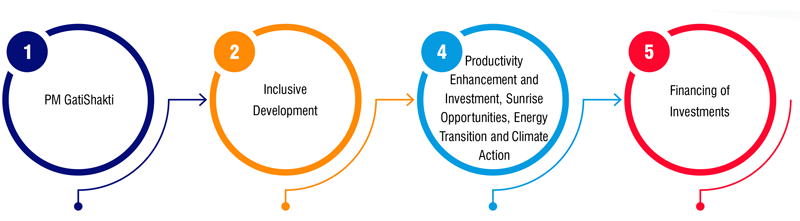

FOUR PRIORITIES

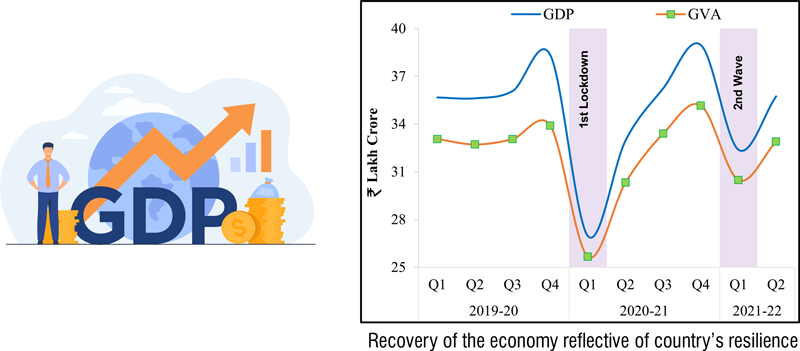

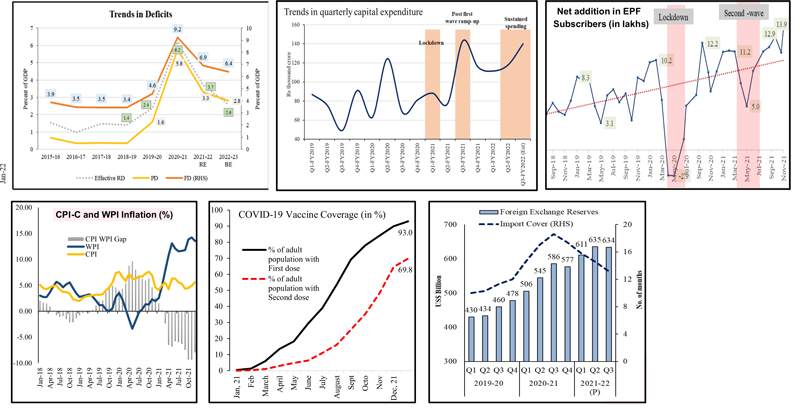

INDIAN ECONOMY STAGING A SUSTAINED RECOVERY

PM GatiShakti

- Promoting chemical free natural farming starting with farmers’ lands close to river Ganga

- Promoting post harvest value addition, consumption and branding of millet products

- Delivery of Digital and Hi-Tech services to farmers in PPP mode.

- Use of Kisan Drones to aid farmers.

- Launching fund with blended capital to finance agriculture start ups

- Implementation of Ken Betwa Link Project benefitting 9.1 lakh hectare farm land, providing drinking water to 62 lakh people and generating 130MW power.

- 5 more such projects under process of implementation.

EDUCATION

UNIVERSALISATION OF QUALITY EDUCATION

- One class One TV channel programme to be expanded to 200 TV channels

- Virtual labs and skilling e-labs to promote critical thinking skills and stimulated learning environment

- A Digital University will be established with world class quality universal education

- High quality e-content will be delivered through Digital Teachers

SKILL DEVELOPMENT

- Virtual labs and skilling e-labs to promote critical thinking skills and stimulated learning environment

- A Digital University will be established with world class quality universal education

HEALTH

- National Digital Health Ecosystem will be rolled out

- National Tele Mental Health Programme will be launched for quality counselling

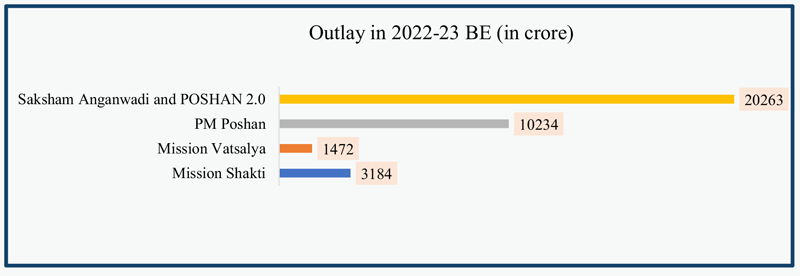

- Integrated architecture: Mission Shakti, Mission Vatsalya, Saksham Anganwadi, and Poshan 2.0 to be launched

- Two lakh Anganwadis to be upgraded to Saksham Anganwadis

Ease of Doing Business 2.0

- Trust based governance

- Integration of central and state level systems through IT bridges

- Expanding scope of PARIVESH Portal

- Unique Land Parcel Identification

- Number for IT based management of land records.

- Establishing C-PACE to facilitate voluntary winding up of companies

- End to end online e-Bill System and utilising surety bonds in government procurement

- AVCG promotion task force

- Support to 5G Under PLI scheme

- Opening up defence R&D for industry, startups and academia

Ease of Living

- Issuance of chip embedded e-Passports

- Modernisation of building byelaws, implementing Town Planning Schemes and Transit Oriented Development

- Establishing Centres of Excellence in urban planning

- Providing a battery swapping policy as an alternative to setting up charging stations in urban areas

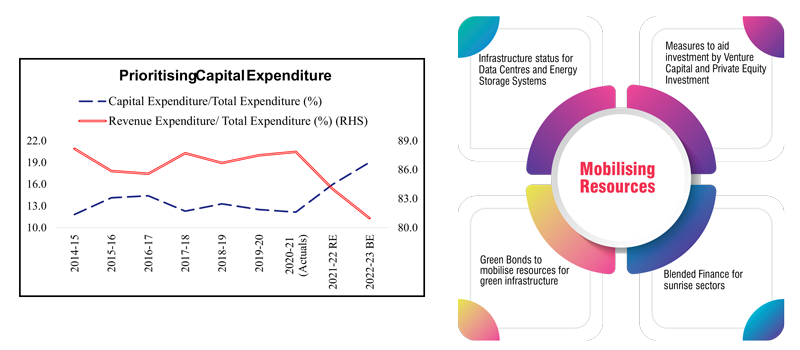

FINANCING OF INVESTMENT

- Public investment to continue to pump prime private investment and demand in 2022-23

- Introduction of Digital Rupee by RBI starting 2022-23

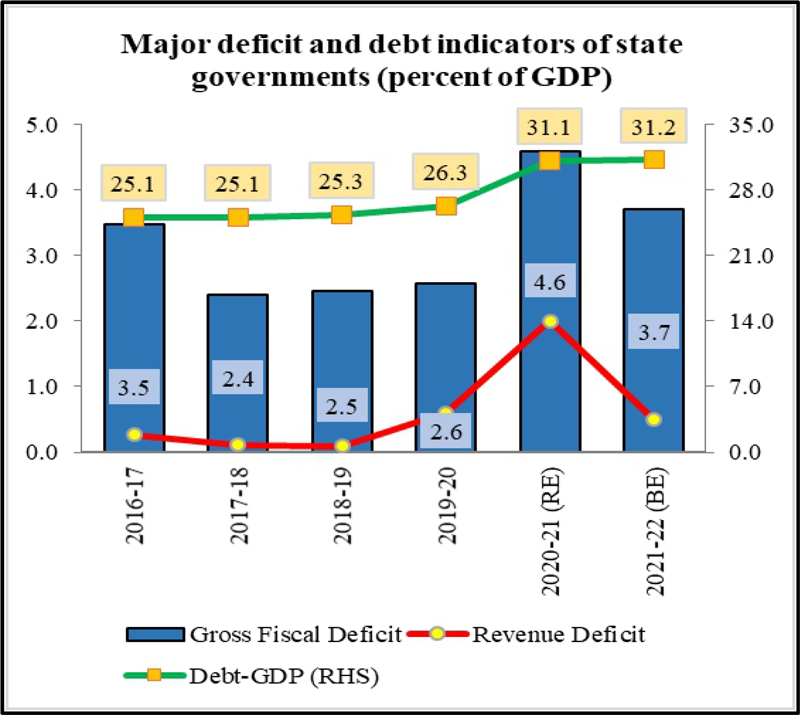

Providing greater fiscal space to States

- Enhanced outlay to Scheme for Financial Assistance to States for Capital Investment

- For 2022-23 States will be allowed a fiscal deficit of 4% of GSDP of which 0.5% will be tied to power sector reforms

Income Tax Proposals

A Window to File the Return (Voluntary Tax Compliance)

- Individuals are given an Option to file an updated return within 2 years from the end of relevant AY to correct any omission or mistake while estimating their Income.

- The individual can file this updated return whether he has filed the original return or not.

- Additional tax as follows will have to paid for the under – reporting income:

If the updated return is filed within 12 months |

25% of aggregate tax and interest |

If updated return is filed beyond 12 months |

50% of aggregate tax and interest |

- The provision of Updated return cannot be availed if the return is of loss or result in decreasing the total tax liability or result in increasing the refund

- Updated return cannot be filed in following cases:

- If assessment/reassessment/revision/recomputation is pending or has been completed for the same AY.

- Where search has been initiated or survey has been conducted

- Information available with the AO under specified laws (PMLA, Black Money, Benami etc.) or on account of India’s tax treaty agreements and the same has been communicated to the taxpayer prior to filing the updated return.

- Prosecution proceedings have been initiated prior to filing of updated return.

- Such person as may be notified

Reduction in Litigation (Section 158AB)

Filing of departmental appeal in a particular case shall be deferred if an appeal is pending on an identical question of law before jurisdictional High Court or the Supreme Court in his case or in the case of any other assessee for an assessment year. The decision to defer will be subject to taxpayer’s acceptance. Appeal to ITAT, HC and SC will be deferred till Question Of Law is decided in respect of identical issue cases.

Cess and Surcharge – Not an Expenditure

- It has been clarified that the term ‘tax’ includes surcharge or cess and is not allowable as a deduction while computing business income.

- This is a clarificatory amendment which is applicable retrospectively from AY 2005-06.

Status of ongoing proceedings in case of business reorganisation

- The assessment or reassessment or any other proceedings made on the predecessor during the course of pendency of such reorganisation shall be deemed to have been made on the successor.

- The entities going through such re-organization can file modified returns within six months by such successor entity to give effect to the final order of the competent authority. Resultant company will be responsible for matters/ issues/ demands of merged company.

Section 14A – Disallowance of expenditure in absence of Exempt Income

It has been clarified that disallowance shall be made for any expenditure incurred in relation to an exempt income even if no exempt income has accrued or arisen or has been received during the said previous year. This clause is appplicable from 1st April, 2022 and will not impact earlier cases.

Disallowed Expenditure U/s Section 37

No deduction of expenditure shall be allowed in the following cases incurred for: •

- Any purpose which is an offence, or which is prohibited by any law both within or outside India.

- To provide any benefit or perquisite to any person, and acceptance of such benefit or perquisite violates any law/rule/regulation/guidelines governing the conduct of such person.

- Compounding of offence both within and outside India

Conversion of interest into Debentures/ Any other instrument – Whether allowed?

It has been clarified that conversion of the outstanding interest liability into debentures or any other instrument by which liability to pay is deferred to a future date is NOT an actual payment and hence will not be allowed as a deduction U/s Section 43B.

Section 115BAB- New Manufacturing Companies

Last date of commencement of manufacturing or production by new domestic companies for availing 15% tax rate is extended from 31 March, 2023 to 31 March,2024.

Startup’s Incorporation

The last date of incorporation of an ‘eligible startup’ has been extended by one year to 31 March 2023.

Co-operative Societies

- Reduction in the rate of Alternative Minimum tax from 18.5% to 15% [ Effective from AY 23-24 onwards]

- Surcharge rate has been reduced from 12% to 7% in cases where income exceeds 1 crore but does not exceed 10 crore.

Payment of “Lump-sum or annuity” to the Disabled

Deduction u/s 80DD now allowed even if policy allows payment to disabled dependent prior to death of policy holder i.e., on attaining 60 years of age. Further payment under such scheme to be discontinued.

Tax treatment of amount received on account of COVID-19

- Medical Treatment

- Any sum received for expenses incurred on treatment of COVID-19 for self and family from employer or otherwise will not be taxable as perquisite.

- On death of the employee

- Ex-Gratia received by the family of the deceased employee from the employer within 12 months from the date of death of the employee shall not be taxable. The death should be on account of COVID-19 and necessary certificate should be taken on record.

- Amount up to INR 10 lakh received from any person other than employer will not be taxable.

TDS at double rates for payment to non-filers of return

The years considered for default for non-filers of Tax return has been reduced from two previous assessment years to only last one assessment year. [ Effective from AY 22-23 onwards]

TDS on sale of Immovable Property

As per the provisions of the Act, a buyer of an immovable property is required to withhold tax at the rate of 1% on the sales consideration paid of a resident seller. Such tax deduction has to be made in case the consideration exceeds 50 lakhs.

It has been proposed that TDS shall be required to be deducted on the higher of:

- Consideration received; or

- Stamp duty value of the property.

TDS on Benefit or Perquisite

TDS at the rate of 10 per cent to apply to any benefit or perquisite arising from a business or profession to a resident. No deduction shall be required where the value does not exceed INR 20,000. [ Effective from 1 July, 2022]

BONUS AND DIVIDEND STRIPPING: PAY MORE TAXES ON DERIVATIVE PROFITS

It is proposed that bonus stripping will be applicable to securities and units of business trusts such as Infrastructure Investment Trust (InvIT), Real Estate Investment Trust (REIT) and Alternative Investment Funds (AIFs).

Also, dividend stripping is proposed to be made applicable to the units of business trusts such as Infrastructure Investment Trust (InvIT), Real Estate Investment Trust (REIT) and Alternative Investment Funds (AIFs). [Effective from AY 2023-24 onwards]

Hence, short term capital gains would not be available for set off,

(a) if original shares are purchased within 3 months prior to record date for bonus

(b) if original shares are sold within 9 months from date of record; and

(c) if continue to hold the bonus shares

DIVIDEND FROM FOREIGN SUBSIDIARY

The concessional tax rate of 15 % on the dividend income received by an Indian company from a foreign company in which the said Indian company holds 26 % or more in nominal value of equity shares (specified foreign company) has been withdrawn w.e.f AY 2023-24 onwards.

Rationalisation of TDS provisions u/s 195

It has been proposed that where no tax was required to be deducted on payments made to non-residents and tax has been deducted by the assesse, then assesse may file an application to Assessing officer to claim refund of such tax. Currently, refund of such tax can only be claimed by filing an appeal to Commissioner (Appeals).

Explanation of “Source” and “Source of Source” in case of Loan u/s 68

The nature and source of any sum, whether in form of loan or borrowing, or any other liability credited in the books of an assessee shall be treated as explained only if the source of funds is also explained in the hands of the creditor or entry provider. The credibility of lender and genuineness of transactions will have to proved even if the loan has been repaid in the end.

However, this additional onus of proof of satisfactorily explaining the source in the hands of the creditor, would not apply if the creditor is a well-regulated entity, i.e., it is a Venture Capital Fund, Venture Capital Company registered with SEBI.

Deferment of Faceless Assessment Scheme in certain cases

Timeline for introducing faceless schemes for Transfer Pricing, International Taxation matters, Dispute Resolution Panel and Tribunal appeals proposed to be extended till 31 March 2024.

Change in Faceless Assessment Scheme

The existing procedures is proposed to be amended as follows to streamline the overall procedure:

- This scheme will be applicable to reassessment or recomputation proceedings u/s 143(3) or 144 or 147 of the Act.

- The assessment proceedings shall now not be considered void if the assessment is not made in accordance with the procedure laid down in the law including technical glitches. – Section 144B(9) [Effective retrospectively from AY 21-22]

- The time limit to file a reply to initial notice changed to date specified in the notice from 15 days’ time period.

- Power to initiate special audit granted.

- Mandatory personal hearing through video conferencing/video telephony if requested by assessee. Prior approval not required.

Taxation of Virtual Digital Assets (VDA)- Cryptocurrency/ NFTs etc.

- Virtual digital assets have gained tremendous popularity in recent times and the volumes of trading in such digital assets has increased substantially.

- A new scheme has been introduced to provide for taxation of such virtual digital assets from AY 2023-24 onwards.

- A virtual digital asset will include any information or code or number or token (not being Indian currency or any foreign currency), generated through cryptographic means or otherwise, non-fungible token or any other token of similar nature are included in the definition.

- Income from the sale of such assets will be taxed at a special rate of 30%. No deduction of any expenditure shall be allowed while calculating the gain from the sale of such asset. Only Cost of acquisition will be allowed as a deduction. Such gains will be taxed under the head “Income from Other Sources”

- No set-off of any loss on sale of such virtual digital asset shall be allowed against any income computed under any other provision of the Act and such loss shall not be allowed to be carried forward to subsequent assessment years.

- TDS @1% from payment to a resident person on transfer of virtual digital asset u/s 194S has been introduced.

- Gift of such Virtual Digital Assets will also be taxable in the hands of recipient if it exceeds Rs. 50,000

- “Further possible implication of dealing in Cryptocurrency”

- GST may be levied on all transactions: Buying or selling pf cryptocurrency is not excluded or exempted in terms of GST.

- FEMA – Transactions of Cryptocurrency with nay international exchange or person is clearly prohibited amd fine upto 3 times value can be imposed.

- Money Laundering: In case of transaction of buying or selling is done with an unknown party – serious allegation of Money laundering in terms of PMLA law.

- Prices of crypto may collapse in India as the Government is getting activated against crypto and its exchange.

Rationalisation of Assessment and Re-assessment Proceedings

It is proposed as follows:

- AO will not be required to take prior approval of specified authority to issue a notice under reassessment.

- AO to modify the assessment order within 2 months from the end of the month in which TPO order is received.

- Reassessment orders to be passed with the approval of higher tax authorities only in the cases of survey, search, and similar action.

- Exclusion of period from the initiation of search till the date when search material is handed over to the jurisdictional AO (not exceeding 180 days).

- Time limit for issue of re-assessment notice: The scope of issue of re-assessment notice beyond 3 years and upto 10 years expanded to include the following in cases where amount exceed 50 lakhs:

- Expenditure in respect of a transaction or an event or occasion.

- Entries in the books of accounts.

- Creation of asset of more than Rs. 50 lakhs was already covered.

Penalties

Penalties for default in furnishing of various returns including TDS and TCS returns u/s 206 & 206C and statements increased to Rs. 500 per day from Rs. 100 per day.

Set-off of Loss in case of Search of Undisclosed Income

No set-off of loss or any unabsorbed depreciation shall be allowed against undisclosed income discovered during search, survey or information requisitioned u/s 132A

Transfer of Intangible Asset

Reduction of Goodwill from block of assets will be considered as Transfer

Charitable Trust

- Books of accounts to be maintained by the trusts and institutions if the net income exceeds maximum amount not chargeable to tax.

- Penalty provisions in case of passing of unreasonable benefits to trustees or specified persons.

- Unspent income of more than 15% of revenue can be carried forward only for 5 years and if not spent till such time to be taxed in the 5th year itself. – Provision to apply to trust or NGO in terms of Section 11(2) as well as 10(23C) institutions.

- In case any income or property of the trust or institution has been applied unreasonably for the benefit of specified trustee or persons, the same will be taxed in the hands of that person.

- Filing of return of income under Section 139(4C) has been made mandatory to claim the exemption under Section 10(23C).

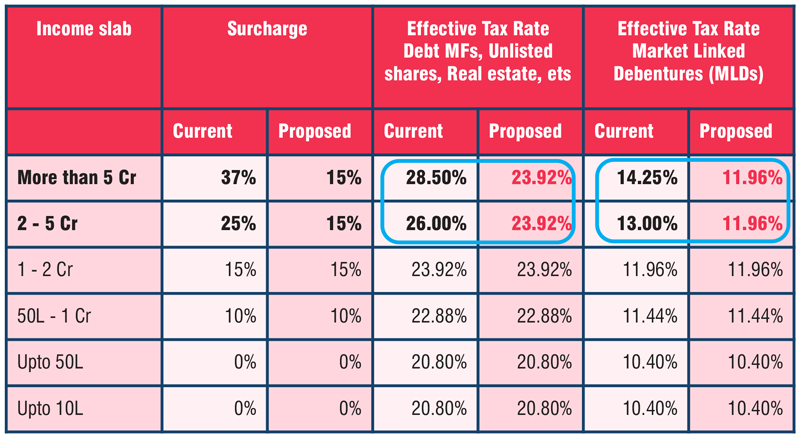

SURCHARGE ON LONG TERM CAPITAL GAINS

Surcharge on long term capital gains capped at 15% for Individuals, HUFs, AOPs and BOIs in case of all capital assets (i.e. unlisted shares, Debt Mutual Fund, MLDs, real estate, etc)

Goods and Services Tax (GST) Proposals

Time Limit to avail ITC Extended to November from September of succeeding year

Time-limit to avail ITC u/s 16(4) extended till 30th November of next year from 30th September. Additional Condition for availment of ITC u/s 16(2) – ITC can be availed only if the same is not restricted in GSTR-2B. (Section 16 of CGST Act, 2017)

Credit Notes for Previous Financial Year – Can be issued till November instead September of succeeding year

Credit Notes in respect of supply made in a financial year can be issued by 30th November of next financial year (currently allowed till 30th September) (Section 34 of CGST Act, 2017)

GSTR-3B/1 can be rectified till 30th November of succeeding year

- Any rectification of error in GSTR-1/ GSTR-3B is now permitted till 30th November of next financial year (currently allowed till 30th September).

- The two-way communication process in filing GST returns is scrapped.

- The due date for filing return by non-resident taxable person is prescribed as 13th day of next month. (Section 37 of CGST Act, 2017)

Sections 42, 43 and 43A of the CGST Act are being omitted so as to do away with two-way communication process in return filing.

Section 38 of the CGST Act is being substituted for prescribing the manner as well as conditions and restrictions for communication of details of inward supplies and input tax credit to the recipient by means of an auto-generated statement and to do away with twoway communication process in return filing. (Section 38 of CGST Act, 2017)

Time limit for Filling GSTR-5 amended

The non-resident taxable person shall furnish the return for a month by 13th day of the following month instead of 20th. (Section 39 of GCST Act, 2017)

Suo Motto Cancellation – Registration under Composition

Composition Tax Payer’s Registration can be cancelled suo-motto if they have not filed their GSTR-4 return beyond 3 months from the due date. (Section 29 of CGST Act, 2017).

ITC to be claimed on Self-assessed Basis instead of Provisional Basis

Section 41 of the CGST Act is being substituted so as to do away with the concept of “claim” of ITC on a “provisional” basis. (Section 41 of CGST Act, 2017)

Late fees will be levied for late Filling of TCS return

Last date of commencement of manufacturing or production by new domestic companies for availing 15% tax rate is extended from 31 March, 2023 to 31 March,2024.

Ledgers Adjustments

The restrictions and maximum limit will be prescribed for utilising the amount available in electronic credit ledger for discharging the output tax liability. • The amount available in E- cash ledger of a registered person is now allowed to be transferred to the E- cash ledger of a distinct person. (Section 49 of CGST Act, 2017)

GOOD NEWS: Interest rate reduced from 24% to 18% retrospectively w.e.f 1st July, 2017: No interest if availed but not utilised

- Section 50(3) of the CGST Act is being substituted retrospectively, with effect from the 1st July, 2017, so as to provide for levy of interest on input tax credit wrongly availed and utilized. (Meaning thereby Interest will not be levied if ITC is not utilized)

- Refund claim of any balance in the electronic cash ledger shall be made available.

- Rate of Interest u/s 50(3) prescribed as 18% in all cases retrospectively, with effect from the 1st July, 2017. (Section 50 of CGST Act, 2017)

Time limit for claiming refund of ITC on inward supplies extend to 2 years from 6 months

UNO & MFIO can claim refund of ITC on inward supplies within 2 years from last day of the quarter in which said supply was received.

Clarity regarding the relevant date for filing refund claim i.r.o. Supply to SEZ

In case of zero-rated supplies or supply to a SEZ, where a refund of tax paid is available in respect of inward supplies, relevant date shall mean the due date for furnishing of return under section 39 in respect of such supplies. (New sub-clause (ba) in clause (2) of Explanation to Section 54 of CGST Act, 2017)

Ineligibility for refund

Unintended waste generated during the production of fish meal (falling under heading 2301), except fish oil, is being exempted during the period commencing from the 1st day of July, 2017, and ending with the 30th day of September, 2019 (both days inclusive), subject to the condition that if said tax has been collected, the same would not be eligible for refund. (Notification No. 01/2017 – Central Tax (Rate), Notification No. 01/2017 – Integrated Tax (Rate), Notification No. 01/2017 – Union Territory Tax (Rate), all dated June 28, 2017)

Granting of license for alcoholic liquor- Not a Supply of Goods or Service

Service by way of grant of alcoholic liquor license, against consideration in the form of license fee or application fee or by whatever name it is called by the State Governments, has been declared as an activity or transaction which shall be treated neither as a supply of goods nor a supply of service. Retrospectively w.e.f. 01.07.2017. However, no refund shall be made of tax which has been collected, but which would not have been so collected, had the said notifications been in force at all material times. (Notification No. 25/2019- Central Tax (Rate), Notification No. 24/2019- Integrated Tax (Rate) and Notification No. 25/2019- Union Territory Tax (Rate) dated September 30, 2019.)

Excise and Custom Duty Proposals

Excise Duty

Change In Effective Rate of Additional Basic Excise Duty On Unblended Petrol And Diesel

In order to promote blending of Motor Spirit (Petrol) with ethanol/methanol and blending of High-Speed Diesel with bio-diesel, an additional Basic Excise Duty of Rs. 2 per Litre on Petrol and Diesel, intended to be sold to retail consumers without blending, would be levied with effect from October 1, 2022.

Custom Duty

Removal of Ambiguity – Class of Officers

Section 3 is being amended to specifically include the officers of Principal Director General of Revenue Intelligence, Audit and Preventive formation in the class of Officers. This amendment has been made to remove any ambiguity as regards the class of officers of Customs.

Section 5 Powers of officers of customs

Sub-Section (1A) and 1(B) to Section 5 have been inserted in section 5 of the Customs Act to explicitly provide power of assignment of function to officers of customs

- the Board may, by notification, assign such functions as it may deem fit, to an officer of customs, who shall be the proper officer in relation to such functions.

- Within their jurisdiction assigned by the Board, the Principal Commissioner of Customs or Commissioner of Customs, as the case may be, may, by order, assign such functions, as he may deem fit, to an officer of customs, who shall be the proper officer in relation to such functions.

Criteria for imposing limitations or conditions

Sub-section (4) to Section 5 is being inserted to delineate the criteria which the Board may adopt while imposing limitations or conditions under sub-section (1) or while assigning functions under sub-section (1A) to the officer of Customs. including, but not limited to–

- territorial jurisdiction;

- cases or class of cases;

- goods or class of goods;

- persons or class of persons;

- computer assigned random assignment;

- any other criterion as the Board may, by notification, specify

Two or More Officers can concurrently exercise powers

Sub-section (5) to Section 5 is being inserted to ensure that wherever necessary, for the proper management of work, two or more officers of customs, can concurrently exercise powers and functions.

Obligation if Imported Goods are not declared truthfully

Sec 14(1): The additional obligations of the importer in respect of any class of imported goods and the checks to be exercised, including the circumstances and manner of exercising thereof, as the Board may specify, where, the Board has reason to believe that the value of such goods may not be declared truthfully or accurately, having regard to the trend of declared value of such goods or any other relevant criteria should be added to the value of imported goods.

Application for Advance Ruling – Withdrawal

Section 28H is being amended to make provisions for prescribing appropriate fees by Board relating to application for advance Ruling and also give flexibility to the applicant to withdraw his application at any time before a ruling is pronounced from the current 30 days’ time period. Consequently, the sub-section (3) is being omitted relating to the quadruplicate application.

Validity of Advance Ruling – Limited to Earlier of 3 years or change in Law

Sub-section (2) under Section 28J is being substituted so that advance ruling under subsection (1) of Section 28J is now valid for a period of three years or till there is a change in law or facts on the basis of which the advance ruling has been pronounced, whichever is earlier. A proviso is also being inserted to provide that the advance rulings in force on the date on which the Finance Bill, 2022 receives assent of the President, the said period of three years shall be reckoned from the date on which the Finance Bill receives assent of the President.

Insertion of new section 110AA. Action subsequent to inquiry, investigation or audit or any other specified purpose.

- any duty has been short levied, not levied, short paid or not paid in a case where assessment has already been made;

- any duty has been erroneously refunded;

- any drawback has been erroneously allowed; or

- any interest has been short-levied, not levied, short-paid or not paid, or erroneously refunded,

then such officer of customs shall, after causing inquiry, investigation, or as the case may be, audit, transfer the relevant documents, along with a report in writing–

- to the proper officer having jurisdiction, as assigned under section 5 in respect of assessment of such duty, or to the officer who allowed such refund or drawback; or

- in case of multiple jurisdictions, to an officer of customs to whom such matter is assigned by the Board, in exercise of the powers conferred under section 5, and thereupon, power exercisable under sections 28, 28AAA or Chapter X, shall be exercised by such proper officer or by an officer to whom the proper officer is subordinate in accordance with section 5(2).

Insertion of new section 135AA Protection of data.

If a person publishes any information relating to the value or classification or quantity of goods entered for export from India, or import into India, or the details of the exporter or importer of such goods under this Act, unless required so to do under any law for the time being in force, he shall be

- punishable with imprisonment for a term which may extend to six months

- or with fine which may extend to fifty thousand rupees

- or with both.

This section does not apply to any publication made by or on behalf of the central government.

Cognizance of offences (Section – 137)

Section 137 is being amended so as to provide that, no court shall take cognizance of any offence w.r.t. protection of the import and export data submitted to Customs by importers or exporters in their declarations without sanction of the Principal Commissioner/ Commissioner of Customs.

Changes in the Customs Rules

Customs (Import of Goods at Concessional Rate of Duty) Rules, 2017 (“the IGCR Rules”) are being amended to provide the following facilities:

- To introduce end to end automation in the entire process. Requirement of submitting all the necessary details electronically, through a common portal, is being brought out in the Rules itself.

- Standardizing and notifying the various forms in which details are to be submitted electronically.

- Leveraging the advantage of such submissions electronically, the need for any transaction based permissions and intimations are all being done away with.

- Consequently, the procedure to claim the notification benefit is being simplified and automated.

- For effective monitoring of the use of goods for the intended purposes, a Monthly Statement is being proposed which is to be submitted by the importer on the Common Portal.

- An option for voluntary payment of the necessary duties and interest, through the Common Portal is being provided to the importer

Duty concessions on specified items when imported by bonafide exporters

A scheme is being introduced for bonafide exporters on duty-free imports for the purpose of use in goods meant for export, based on end-use monitoring subject to the requirement of exporting value added products manufactured using inputs imported under specified exemptions, within a period of 6 months. Importer shall be required to follow the procedure under the IGCR Rules.

Changes in Customs Tariff

- Simplified the customs rate and tariff structure, particularly for sectors like chemicals, textiles and metals and minimize disputes.

- The government has also raised tariffs on imported headphones, loudspeakers, smart meters used by power distribution companies and solar panels as a part of the budget proposals

- Around 350 more exemptions are proposed to be phased out which include goods used in agricultural sector, chemicals, fabrics, medical devices and drugs.

- More than 40 exemptions on capital goods/ project imports are proposed to be phased out gradually which includes goods used in textile sector, power sector, petroleum sector, leather sector, food packaging and other sectors.

- Moderate tariff of 7.5% is being introduced for Project imports

- The also removed exemption on items which are or can be manufactured in India and provided concessional duties on raw material that go into manufacturing of intermediate products – in line with the objective of ‘Make in India’ and ‘Atmanirbhar Bharat’

Here is what gets cheaper from this year:

Diamonds and gems: Customs duty on cut and polished diamonds and gemstones has been reduced to 5 per cent; Nil customs duty to simply sawn diamond

Mobile phone and chargers: The government has introduced duty concessions to parts of transformer of mobile phone chargers and camera lens of mobile camera module and certain other items to enable domestic manufacturing of high growth electronic items.

Wearable devices will become cheaper too: Customs duty rates will be calibrated to provide a graded rate structure to facilitate domestic manufacturing of wearable devices, hearable devices and electronic smart meters.

Chemicals: Customs duty on certain critical chemicals namely methanol, acetic acid and heavy feed stocks for petroleum refining will be reduced

Steel: Customs duty exemption given to steel scrap last year has been extended for another year to provide relief to MSME secondary steel producers. Also, anti- dumping and CVD on stainless steel and coated steel flat products, bars of alloy steel and highspeed steel are being revoked – to tackle prevailing high prices of metal in larger public interest.

Here is what gets costly from this year:

- Headphones and earphones to 20% from 15%

- Single or multiple loudspeakers to 20% from 15%

- Smart meters to 25% from 15%

- Solar cells to 25% from 20%

- Solar modules to 40% from 20%

- Sodium cyanide to 10% from 7.5%

- Microbial fats and oils and their fractions to 100% from 30%

- The government has also raised tariffs on imported headphones, loudspeakers, smart meters used by power distribution companies and solar panels as a part of the budget proposals

- Imported Umbrellas being raised to 20%