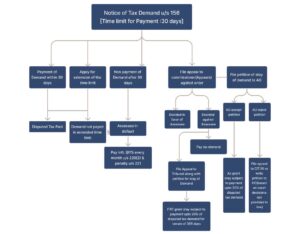

After the completion of the Assessment/Penalty proceedings, in the cases where the Assessing Officer has difference of opinion on interpretation of law or facts /explanations as offered by the assessee during the assessment/penalty proceedings, the Assessing officer proposes the addition in income and issues assessment/penalty order under the respective sections of the Income Tax Act, 1961 (hereinafter referred as “the Act”) along with notice of demand u/s 156 of the Act.

This article provides guidelines on dealing with such Notice of Demand in light of provisions of Income Tax Act and legal decisions pertaining to stay or recovery of tax demands.

A. Provisions of Income Tax Act:

B. Instructions of CBDT in regard of stay of demand

In order to provide relief to the assesses during pendency of appeal before CIT(A), Instructions dated 29.02.2016 were issued wherein it was provided as a general rule that in the cases where outstanding demand is disputed before CIT(A), the Assessing Officer shall grant stay of demand till disposal of first appeal on payment of 15% of disputed demand. The Assessing Officer was also given a discretion to direct for payment of higher or lower amount in deserving cases with the approval of Pr. Commissioner / Commissioner. It was also provided in the circular that in case the assessee is not satisfied with the decision of the Assessing Officer for making payment of 15% of the disputed demand, he can approach the Pr. Commissioner / Commissioner for review of the decision.

These Instructions were revised on 31.07.2017. It was stated that rate of 15% was found to be on the lower side which revised to 20% of demand. The aforesaid Instructions dated 31.07.2017 are in force at present. In the light of aforesaid Instructions, the Assessing Officers are insisting on payment of 20% of the demand in all the cases irrespective of the merits of the case or quantum of the demand.

C. Legal decisions pertaining to stay or recovery of tax demands

- No automatic grant of stay of demand (Paulsons Litho Works 208 ITR 676(Mad)) Mere filing or pendency of appeal before Commissioner (Appeals) does not constitute automatic stay of the order under challenge or recovery of tax or penalty under dispute in such appeal.

- Stay of demand on payment of amount less than 20% Commissioner is not bound by administrative circulars issued by the CBDT and can grant stay of demand on payment of an amount less than 20% (Civil Appeal No. 6850 of 2018 – PCIT vs LG Electronics India Pvt Ltd)

- AO to judicially use discretion on stay petition: Courts have held that AO discretion on decision of stay petition is coupled with duty and must be exercised in a just, reasonable and fair way.The High Court in the case of KEC International Ltd. 251 ITR 158(160) has given guidelines to the Income tax authorities which should be kept in mind while deciding the stay application:

- Conflicting decisions of High Court on subject matter

- Grounds of appeal

- Financial position of the Assessee

- Proof of appea

- AO power to curtail payment of 30 days Though proviso to section 220(1) empowers AO to grant period shorter than 30 days in Notice of Demand for making payment, AO cannot curtail the period of 30 days without valid reasons recorded in writing.

In Mahindra and Mahindra Ltd. v. Assessing Officer (2007) 295 ITR 43 (Bom) (High Court), the court held that, no coercive / recovery action should be taken till the expiry of the appeal period against the said order is over. - HC grants refund of Tax Recovered in excess of 20% against disputed Demand Rajasthan High Court directs AO to refund the excess amount being 80% of the demand that is already recovered from the petitioner. The AO is entitled to keep 20% of the demand (Ram Gopal Sharma Vs ITO (Rajasthan High Court).

- AO to release refund beyond 20% of tax demand even if 65% of demand adjusted by CPC The Gujarat High Court held that as per the CBDT’s guidelines, AO is required to grant stay of demand till disposal of the First Appeal where the outstanding demand is disputed before the CIT (Appeals) on payment of 20% of the disputed demand. The only reason given by the AO for denying the request of the assessee was that the adjustment of the refund against the demand was done by the CPC system. This approach on the part of AO was not endorsable. AO was directed to refund the excess amount adjusted beyond the 20% demand raised (Neo structo construction pvt ltd vs Assistant Commissioner of Income Tax department).

- Delhi HC restricts Set-off of Tax Refunds Against Disputed Demands at 20% In case of Jindal Stainless LTD vs DCIT (Deputy Commissioner of Income Tax), HC held that adjustment of outstanding tax demands against refunds should not exceed 20% of the disputed amount.