Introduction

During the month of September 2019, our Finance Minister Mrs N. Sitharaman gifted the Indian Industrial sector a much-awaited tax rate slash making Indian industry more competitive around the world. With the Taxation (Amendment) Ordinance Act 2019 the Hon’ble Ministry introduced a Section 115BAA (New tax rate for domestic companies) in the Income Tax Act, 1961 giving an option to the domestic company to a pay corporate tax at a rate lower than the existing one from the FY2019-20 (relevant AY 2020-2021).

This bold and historic decision of reducing the corporate tax rate for new companies in the manufacturing sector to an unprecedented level was taken. Such reduction of corporate tax rates will make India a new destination to make fresh Investments in the coming future. The Finance Minister in her speech quoted

“प्रजानामेवभूत्यर्थंसताभ्योबलिमग्रहीत्।

सहस्रगुणमुत्स्रष्टुमादत्तेहिरसंरविः॥“

Surya, the Sun, collects vapour from little drops of water. So does the King.

They give back copiously. They collect only for people’s wellbeing. [Verse 18, Sarga 1 Raghuvamsa by Kalidasa]

While believing that our economy will reap huge returns on this crucial tax amendment in due course of time and have a multi-fold beneficial outcome.

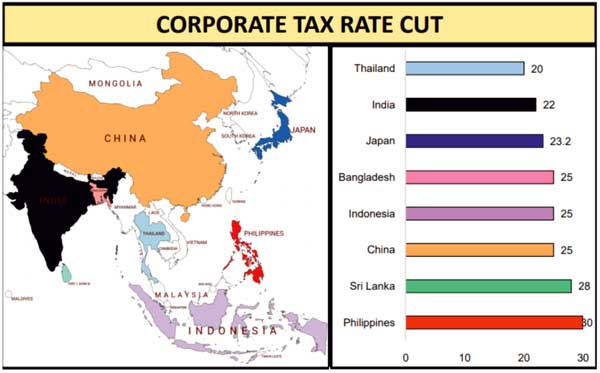

The rate cut has made India amongst the few Asian-Pacific nations which have the lowest tax rate and dreamland for the Industrialist to establish their manufacturing unit in purview to reduce their overall cost.

The introduction of Section 115BAA and Section 115BAB to the Act has given a option as well as challenge for the domestic companies for choosing tax rates available which is as follows:

Description |

Existing Rate* |

Domestic Company |

|

Gross Receipts > 400 Crore in FY 2018-19 onwards

|

31.24% 33.38% 34.95% |

Gross Receipts < 400 Crore in FY 2018-19 onwards

|

26% 27.82% 29.12% |

New manufacturing companies set up and registered on or after 1 October 2019 not availing incentives (Optional) – Section- 115BAB |

17.16% |

Other domestic companies not availing incentives (Optional) Section-115BAA |

25.17% |

*Includes applicable surcharge and cess

*Total Income shall have the same meaning as provided under section 5 of the Income Tax Act

*Gross Receipt/ Turnover shall have the same meaning as provided by the guidance note of the ICAI. Since the same has not been defined anywhere in the Act

We at INMACS through this newsletter attempts to bring out an analysis of the provision of section 115BAA inserted as a “NEW TAX REGIME” for domestic companies. We have tried to cover extensively all the aspects one need to consider while taking a decision between the appropriate option. We hope that our readers would find this informative and helpful.

Section 115baa – New Tax Rate For Domestic Companies

Comparison Of Tax Rates

Category I |

Category II |

|||||

Category of Taxpayer |

Tax liability under normal provisions for domestic companies having Turnover INR 400Cr. in FY 2017-18 |

Tax liability under Section 115BAA |

Net Saving in taxes |

Tax liability under normal provisions for domestic companies having Turnover>INR 400Cr. in FY 2017-18 |

Tax liability under Section 115BAA |

Net Saving in taxes |

Income up to INR 1 Cr. |

26.00% |

25.17% |

0.83% |

31.24% |

25.17% |

6.03% |

Income more than INR 1 Cr. but up to INR 10 Cr. |

27.82% |

25.17% |

2.65% |

33.38% |

25.17% |

8.21% |

Income more than INR 10 Cr. |

29.12% |

25.17% |

3.95% |

34.95% |

25.17% |

9.77% |

Eligibility Criteria

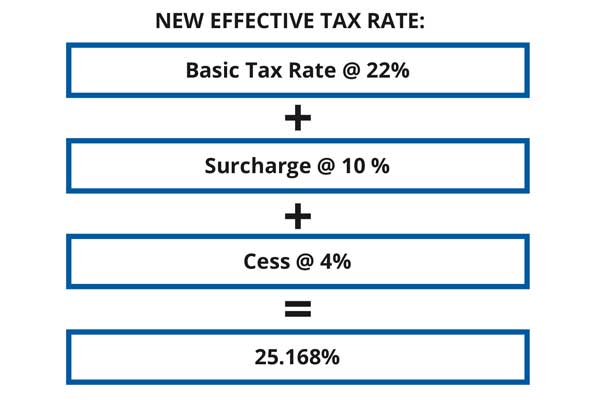

ll domestic companies (excluding branch, Permanent Establishment of foreign companies, firms, LLP, partnership firms) shall have an option to pay income tax at the rate of 22% (plus applicable surcharge @ 10% and cess @ 4%).

Such companies will have to surrender the following exemptions/ deductions under the different provision of this act while calculating for the income chargeable to tax:

S.No. |

Section/ Chapter of the Act |

Particulars |

a. |

Section 10AA |

Claiming any deduction especially available for units established in special economic zones |

b. |

Section 32(1) (iia) |

Additional Depreciation in case of new plant and machinery which has been acquired and installed after 31 March 2005, by a company engaged in the business of manufacture or production of any article or thing or in the business of generation, transmission or distribution of power. |

c. |

Section 32AD |

Deduction for investment in new plant and machinery in notified backward areas in certain states. |

d. |

Section 33AB |

Claiming deduction for tea, coffee and rubber manufacturing companies. |

e. |

Section 33ABA |

Claiming deduction towards deposits made towards site restoration fund by companies engaged in extraction or production of petroleum or natural gas or both in India. |

f. |

Section 35(1)(ii) |

Deduction for any sum paid to a research association which has as its object the undertaking of scientific research or to a university, college or other institution to be used for scientific research. |

g. |

Section 35(1) (iia) |

Deduction for any sum paid to a company to be used by it for scientific research. |

h. |

Section 35(1)(iii) |

Deduction for any sum paid to a research association which has as its object the undertaking of research in social science or statistical research or to a university, college or other institution to be used for research in social science or statistical research. |

I. |

Section 35(2AA) |

Deduction for any sum paid to a National Laboratory or a University or an Indian Institute of Technology or a specified person with a specific direction that the said sum shall be used for scientific research undertaken under a programme approved in this behalf by the prescribed authority. |

j. |

Section 35(2AB) |

Weighted **Deduction of 150% for any revenue or capital expenditure on scientific research (not being expenditure in the nature of cost of any land or building) on in-house research and development facility as approved by the prescribed authority, by a company engaged in the business of biotechnology or in any business of manufacture or production of any article or thing, not being an article or thing specified in the list of the Eleventh Schedule. |

k. |

Section 35AD |

**Deduction in respect of capital expenditure incurred for the purposes of any specified business (refer the definition given below). |

l. |

Section 35CCC |

**Deduction for expenditure on agricultural extension project. |

m. |

Section 35CCD |

**Deduction for expenditure on skill development project. |

n. |

Deduction under chapter VI-A |

Claiming deduction under chapter VI-A in respect to certain incomes, which are allowed under section 80IA, 80IAB, 80IAC, 80IB and so on, except weighted deduction under section 80JJAA in respect of incremental employees. |

*Further, claiming a set-off of any loss carried forward from earlier years, if such losses were incurred in respect of the aforementioned deductions shall not be allowed to any future year and shall lapse in the year in which company opts for Sec-115BAA.

**The Companies can claim revenue expenditure as a normal deduction and on capital Expenditure, the Company can avail normal depreciation.

Analysis Of Certain Critical Issues

Restriction Over Utilisation Of Previous Brought Forward Losses

Generally, a company is allowed to carry forward its loss under the head “Profits and Gains of Business or Profession” for the period of 8 (eight) assessment year immediately succeeding the year in which the loss is incurred. Such brought forward loss shall be eligible for set-off from the future business profits of the company.

However, if any domestic company opts for taxation under section-115BAA then such domestic company opting for the New Tax Regime shall not be eligible to claim brought forward loss to the extent it pertains to the deductions/ exemption mentioned in the Table- 1 above. The balance assessed loss will be allowed to be carried forward and set off normally. The company needs to prudently analyse & evaluate whether the future benefit from surrendering such loss is beneficial or not over the benefits of the reduced tax rate.

Moreover, loss relating to deduction under section 35(2AB), once disallowed in terms of aforesaid provisions, the assessee will be entitled to claim depreciation on the capital expenditure incurred on scientific research in the normal course.

If any domestic company opts for taxation under New Tax Regime and have any brought forward unabsorbed depreciation of previous assessment year attributable to deductions claimed u.s 32(1)(ii) as additional depreciation, then income computed for tax purpose of the relevant assessment year shall be computed by ignoring such additional depreciation remaining unabsorbed, for the assessment year in which the option has been exercised and future assessment years. The written down value for the purpose of calculating depreciation will also be modified by adding back such depreciation in the written down value (WDV).

Hence, as per proviso to Section 115BAA(3) of the Act, if any additional depreciation as per Section 32(1)(iia) has not been given full effect by way of adjustment against income in the years prior to assessment year, prior to AY 2020-21, then such domestic companies will be allowed to make corresponding adjustment to the written down value of the block of assets as on 1 April 2019 provided such domestic companies opt for Section 115BAA of the Act for AY 2020-21 on or before the due date specified under Section 139(1) of the Act for furnishing the return of income.

Non Applicability Of Provisions Of Minimum Alternate Tax (Mat) Under Section-115jb

As per Section 115JB of the Act, provisions relating to MAT will not apply to those domestic companies which exercise option under Section 115BAA of the Act or Section 115BAB of the Act.

Hence the balance lying in the account of MAT credit shall fully lapse if companies opt for payment of tax under new regime.

This has been clarified by way of CBDT vide circular 29/2019.

In nutshell, the companies shall no longer be liable to pay MAT based on Book Profits and entirely carried forward MAT credit shall also lapse.

Hence, it will become matter of analysis with regard to choosing an appropriate tax rate from a carton of tax rates keeping in mind the brought forward losses, unabsorbed depreciation and MAT Credit balance. The companies will have to analyse the future projections and tax liability and arrive at a prudent decision.

Illustrations

The following illustration would help the reader to get more clarity over the above mentioned issues.

An XYZ Co. is domestic company which wants to opt taxation u/s 115BAA for the AY 2020-2021. The company has the following information in the return of income of the AY 2020-2021

Assessment Year |

Brought Forward Loss from Business |

Unabsorbed Depreciation on account of Additional Depreciation |

MAT Credit entitlement available |

2017-18 |

2.00 |

1.00 |

2.50 |

2018-19 |

3.00 |

1.00 |

1.50 |

2019-20 |

1.00 |

0.00 |

2.50 |

Total |

6.00 |

2.00 |

6.50 |

Now let’s assume the following scenario for the AY 2020-2021

Scenario* |

Net Profit / (Loss) |

Book Profit u/s 115JB |

Analysis |

i |

Loss of Rs. 8.00 crore |

5 crore |

OPTION I : OPTS FOR NEW TAX REGIME – No tax in current year. But Mat Credit of 6.50 crore will lapse and 2 crore of unabsorbed depreciation will also lapse. OPTION II : DOES NOT OPT FOR NEW TAX REGIME be paid on book profits @ 15.6% amounting to INR 78 lakh. Although such tax paid under MAT shall available for future credit. Moreover MAT Credit and unabsorbed depreciation will be intact. CONCLUSION: Therefore, if company foresee that in future they would be incurring taxation loss and would be liable to pay tax under MAT provision, then the company should opt for taxation under New Tax Regime. |

ii |

(7.00) |

(4.50) |

OPTION I : OPTS FOR NEW TAX REGIME: No tax in current year. However complete unabsorbed depreciation on account of additional depreciation & MAT credit shall lapse. OPTION II : DOES NOT OPT FOR NEW TAX REGIME: No tax in current year as the company has incurred net loss. No effect on the brought forward MAT credit and unabsorbed depreciation. CONCLUSION: Therefore, it's advisable not to opt for new tax regime since the tax liability would be Nil in either case. Further the company would be able to carry forward the balance unabsorbed additional depreciation & MAT credit to future years. |

iii |

7.5 |

20.00 |

OPTION I : OPTS FOR NEW TAX REGIME: The company shall be liable to pay tax @ 25.168% after deduction of set of brought forward business loss (i.e. 7.5 crore – 6 crore)=1.5 crore @ 25.168% = 0.377 crore ( current year tax). Further company has to forgo entire Unabsorbed Depreciation and MAT Credit. OPTION II : DOES NOT OPTS FOR NEW TAX REGIME: The company needs to pay MAT @15.6% on 20 crore as book profit is more than normal profits. Moreover MAT Credit and unabsorbed depreciation will be intact CONCLUSION: If company foresees that in future year as well they would be liable to pay Tax under MAT only due to higher book profits they should opt for Tax under the new regime to save the higher tax outflow. However in such a situation company won't be allowed to carry forward any MAT Credit & unabsorbed depreciation from previous years to any of the future years. |

iv |

7.5 |

2.5 |

OPTION I : OPTS FOR NEW TAX REGIME: The company shall be liable to pay tax @ 25.168% after deduction of set of brought forward business loss (i.e. 7.5 crore – 6 crore) 0.377 crore. Further company has to forgo entire Unabsorbed Depreciation and MAT Credit. OPTION II : DOES NOT OPTS FOR NEW TAX REGIME: In such scenario company need not pay any tax as it can utilise the brought forward unabsorbed depreciation of upto 1.5 crore in addition to the set off of business losses of 6 crore. The company will also be able to carry forward MAT Credit of 6.5 crore and Unabsorbed Depreciation of 0.5 crore CONCLUSION: It's advisable not to opt for new tax regime since the tax liability would be Nil in other case where company does not opts for taxation under new tax regime. Further the company would be able to carry forward the balance unabsorbed additional depreciation & MAT credit as prescribed to future years. |

*Every Scenario further needs a detailed tax analysis from company future perspective as well on case to case basis as the situation may vary year to year. The option once exercised can not be changed in future years.

Procedural Aspects

- domestic companies willing to be taxed under the section 115BAA will have to opt for this option before the due date of filing the income tax return of the assessment year.

- Once the option is exercised in a particular assessment year, it cannot be changed subsequently.

- Domestic companies having a tax-holiday period can opt for lower taxation after this exemption But once opted this option cannot be withdrawn.

- The option to be exercised in accordance with the provisions of sub-section (5) of section 115BAA by a person, being a domestic company, shall be in Form No. 10-IC.

- The option in Form No. 10-IC shall be furnished electronically either under digital signature or electronic verification Code.

- The forms seek general details of the company along with a declaration that “the option once exercised for any previous year, cannot be subsequently withdrawn for the same or any other previous year ”

Other Points To Be Considered

- There is no restriction for entities formed by restructuring/ use of old plant & machinery/ use of building earlier used as hotel or convention centre.

- This option of a lower tax rate is available to all Domestic Companies, subject to aforesaid There is no eligibility date regarding the incorporation of companies.

How We As Inmacs Can Help You With

- We can offer assistance to determine whether opting for the new tax regime will be beneficial for the company or not.

- We can assist you in making fresh investment in India if you are an Foreign investor wanting to invest in growing economy and related tax advisory.

- We can help you with restructuring to help you optimise the benefit from the scheme.

- We can assist to with filing of income tax returns and other forms including tax Audit and other legal & compliance procedure under Income-tax Act, besides structuring and guiding on various business transactions to keep the tax liability to a minimum level, fully in accordance with law and Rules.

- We provide you with a legal & other statutory guidance in respect of your business compliance and tax planning, besides assessments and appeals.