Background

What is Direct Tax Vivad se Vishwas Bill, 2020 [the Scheme] ?

Who can opt?

Any taxpayer whose appeal is pending before the following appellate authorities as on 31/01/2020 can opt for the settlement in the scheme:

- CIT – Appeal

- Income Tax Appellate Tribunal (ITAT)

- High Court

- Supreme Court of India

- Person in whose case order has been passed by AO/CIT(A)/ITAT/HC in Writ on or before 31/01/2020 and the time of filing appeal has not

- A person who has filed objection before DRP u/s 144C & DRP has not given directions on or before 31/01/2020 or

- DRP has issued directions u/s 144C(5) but AO has not passed order U/s 144c(13).

- A person who has filed an application for revision u/s 264 & such application is pending on 31/01/2020.

When scheme can’t be availed

- AY in respect of which an assessment has been made u/s 142(3), 144 or 153A or 153C of the Income-tax Act on the basis of search u/s 132/ 132A, if the amount of disputed tax exceeds 5 crores

- AY in respect of which prosecution has been instituted on or before the date of filing of declaration;

- Any undisclosed income from a source located outside India or undisclosed asset located outside India;

- An assessment or reassessment made on the basis of information received under an agreement referred to in section 90 or section 90A of the Income-tax Act, if it relates to any tax arrear;

- Persons against whom prosecution has been initiated under unlawful activities, Narcotics Drugs, Corruption Act, Indian Penal code

Persons to whom detention order has been made under conservation of Foreign Exchange & Smuggling Activities

Benefits of availing scheme

-

In case of an appeal involving disputed tax liability

- The designated authority shall not institute any proceeding in respect of

- an offence; or

- impose or levy any penalty; or

- charge any interest under the Income-tax Act in respect of tax

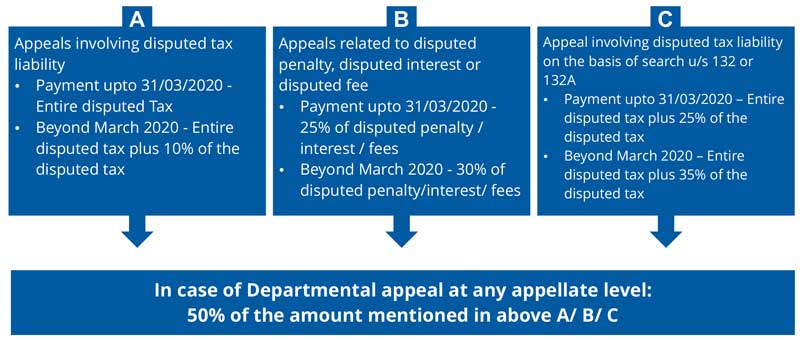

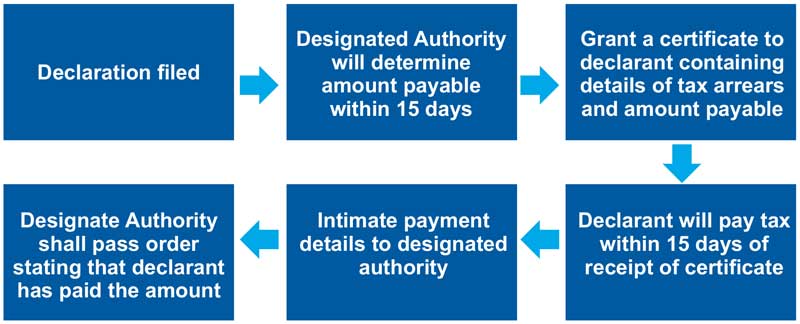

What to pay to claim the relief under this scheme and payment Schedule

Any taxpayer whose appeal is pending before the following appellate authorities as on 31/01/2020 can opt for the settlement in the scheme:

Other Important Points

- Assistance in getting the statutory registration and approved as a startup

- Accounting, Taxation, and other financial matters including Income tax and GST

- Assist you in any kind of transaction whether related in merger & acquisitions, share sale or purchase and out tax planning

- Can provide assistance in Legal matters at any

S.No. |

Pending Appeals |

Decision |

Amount payable under Scheme |

1 |

Appeal filed before CIT (Appeals) or before Dispute Resolution Panel on a issue |

In favour at ITAT level or High Court or Supreme Court |

50% of the amount as referred above |

2 |

Appeal filed before ITAT |

In favour at High Court or Supreme Court |

50% of the amount as referred above |

Other Important Points

a. Withdrawal of Appeals: CIT (Appeals) and ITAT (Appeals)

The appeals pending before ITAT and CIT (Appeals) in respect of the disputed arrears shall be deemed to have been withdrawn.

b. Withdrawal of Appeals: High Court and Supreme Court

The appeals pending before High Court and Supreme Court shall be withdrawn by the appellant after filing the certificate and payment proof to the designated Authority.

- Any material particulars furnished under the declaration is found

- The declarant violates any of conditions referred in this

- The declarant acts in any manner which is not in accordance with the undertaking

D

Amount paid under this scheme shall not be refundable. If the amount payable exceeds the amount paid, the declarant shall be entitled for refund of such excess amount without interest.

- Clarifies that matters pending before AAR are not covered within the scope of the Scheme. However, also clarifies that wherever writ is filed against AAR order and such order determines the total income of the assessee, such cases can be settled under the Scheme and AO shall pass consequential order wherever required;

- Clarifies that where assessment has been set aside for giving opportunity of hearing (except where assessment is cancelled with a direction for de novo assessment), the benefit of the scheme would be available. In such cases, assessee would also be required to settle other issues which have not been set aside and where the appeal is pending/ time to filed appeal not expired, under the scheme;

- Regarding different appeals pending for penalty and quantum addition, Circular clarifies that both appeals (for quantum addition and penalty) would have to be settled and the scheme does not allow settlement of only penalty However, in such cases the assessee would get benefit of waiver of penalty on settlement of disputed tax.

- Where appeals regarding fees u/s 234E or 234F are pending along with appeal involving disputed tax, the Circular clarifies that settling disputed tax would not settle disputed fees. Therefore, the appellant would need to pay 25% or 30% of fees for settlement of such disputes under the scheme.

- Also clarifies that where assesse has filed writ challenging notice u/s 148, but no order of assessment has been passed, such cases would not be covered under the Scheme

- Waiver application for Sec 234A/B/C interest are not covered under the Scheme

- The Circular also clarifies that where the assessee has not filed objections before DRP against the draft order and AO is yet to pass the final assessment orders, such cases would be covered under the Scheme and disputed tax would be calculated based on the draft order. It is clarified that in such case, assessee should specify in the form that time to file objections before DRP not expired

- Scheme does not cover disputes relating to STT, wealth tax, Commodities transaction tax, equalisation levy

- The Circular clarifies that in case of multiple assessment orders for same year, assessee would have an option to settle a few or all appeals relating to such assessment orders.

- The Circular also clarifies that where notice for initiation of prosecution is issued with reference to tax arrears, the taxpayer has a choice to compound the offence and opt for the Scheme

- In respect of TDS disputes, clarifies that consequential relief from disallowance u/s 40(a)(i)/(ia) would be available in the year in which tax was required to be deducted, provides illustrations to explain different scenarios

- Further clarifies that if deductee settles TDS dispute, the consequential relief is available to deductor, however he will be required to pay interest u/s 201(1A). Such interest can also be settled under the Scheme by paying 25%/30% of disputed interest

- Where there is substantive as well as protective addition on the same issue, substantive addition can be settled under the Scheme while rectification order for deleting protective addition would be passed for same or another assessee.

- States that provisions of secondary adjustment u/s 92CE would apply to taxpayers availing the benefit of the Scheme, also clarifies that primary adjustment for AY 2016-17 or earlier AY are not subjected to secondary adjustment provisions;

- Where dispute relates to reduction of MAT credit or reduction of loss or depreciation, the appellant shall have an option either to (i) include the amount of tax-related to such MAT credit or loss or depreciation in the amount of disputed tax and carry forward the MAT credit or loss or deprecation or (ii) to carry forward the reduced tax credit or loss or depreciation. CBDT will prescribe the manner of calculation in such cases

- Clarifies that making a declaration under Vivad se Vishwas shall not amount to conceding the tax position.