Introduction

In today’s world, the trusts or institutions are being widely set up for the charitable purposes and imparting education among the poor. But lesser are known the facts about the taxability and registration of the trust or institution. This newsletter is prepared to gives an insight of the trust with a broad and wide overview regarding the procedure of the registration and the exemptions available to a trust.

With a very strong foundation of cultural & moral values in India, every citizen tends or hope to help the ones in difficult time irrespective of one’s religion, caste, age, region etc. This divine light in heart and mind of every citizen in India always make us unique and different from rest of the World. Though one doesn’t need any specific institution to do anything good for another but by incorporating an institute a person can make sure that his/ her philanthropic work can be continued for an indefinite period.

ne of the greatest example are of the galaxy of Tata Trusts which is one of the India’s oldest charitable organisations being set-up in 1892 by J N Tata Endowment. These trusts have played a very crucial role in pre-as well as post-Independent India’s philanthropic sphere. Its social works are spread in arts, charity, digital transformation, education, health, livelihood, nutrition, sanitation, social justice, sports, skill development and water among others.

What Do You Mean By Trust?

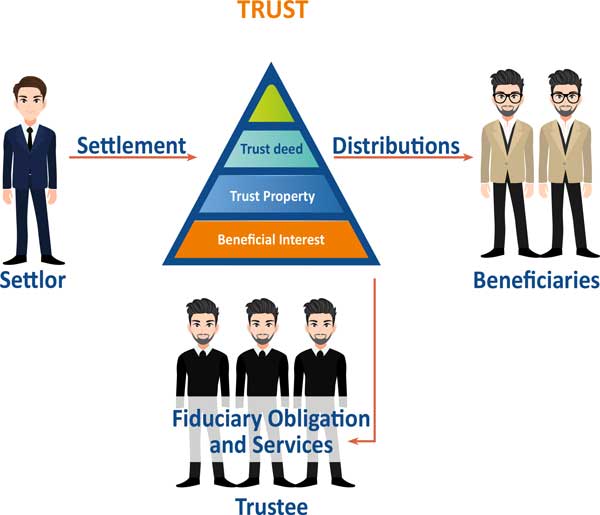

Trust is defined in section 3 of the Indian Trust Act, 1882 as:

“an obligation annexed to the ownership of property and arising out of a confidence reposed in and accepted by the owner, or declared and accepted by him, for the benefit of another or of another and the owner”.

Simply said, it is a transfer of property by one person (settlor) to another (trustee) who manages that property for the benefit of someone else (beneficiary). The settlor must legally transfer ownership of the assets to the trustee of the trust.

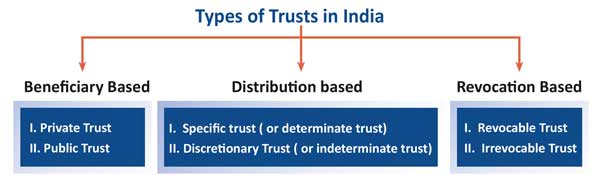

Types Of Trusts In India

How The Creation Of Trusts Work In India?

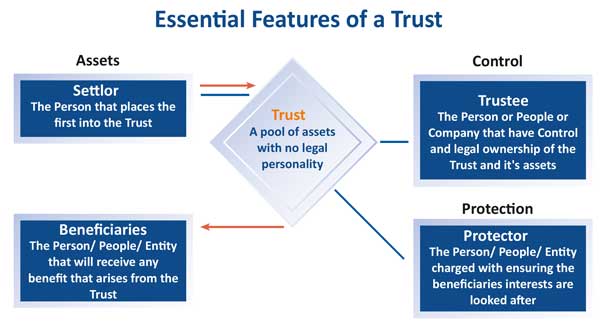

The following elements are essential for the formation of a Trust:

- An Author or Settlor of the Trust- the person who reposes or declares the confidence

- The Trustee – The person who accepts the confidence.

- The Beneficiary – The person for whom the confidence is reposed or declared.

- The Trust Property – It is the subject matter of the trust.

- The objects of the Trust – The intention of setting up of trust

As per Section 6 of the The Indian Trusts Act, 1882 a Trust is created when the Author of the Trust indicates with reasonable certainty by any words or acts the following:

- An intention on his part to create a Trust;

- The purpose of the Trust;

- The Beneficiary; and

- The Trust Property, and

- unless the trust is declared by will or the author of the trust is himself to be a trustee transfers the Trust Property to the Trustee.

As per Section 4 of The Indian Trusts Act, 1882 a trust may be created for any lawful purpose. The purpose of a trust is lawful unless it is:

- forbidden by law, or

- is of such a nature that, if permitted, it would defeat the provisions of any law, or

- is fraudulent, or

- involves or implies injury to the person or property of another, or

- the Court regards it as immoral or opposed to public policy.

Every trust of which the purpose is unlawful is void. And where a trust is created for two purposes, of which one is lawful and the other unlawful, and the two purposes cannot be separated, the whole trust is void.

Further, if the condition mentioned above is satisfied then by executing a trust deed a trust can be formed. An oral trust is also valid but suffer from serious limitations. A Trust deed is desirable and always advisable by experts to give trust a legal protection from becoming void anytime in future. When a private Trust pertains to an immovable property a written and executed trust deed is essential and shall also require to be registered except where the Trust is created by a will. In case of public Trust for immovable property, a written Trust deed is not mandatory but desirable. In relation to Trusts for movable property (public or private), a simple delivery of possession with a direction that the property be held under Trust, is sufficient; it requires no document or registration. It is however recommended that a formal trust deed is executed and registered to enable smooth functioning and recognition for all purposes.

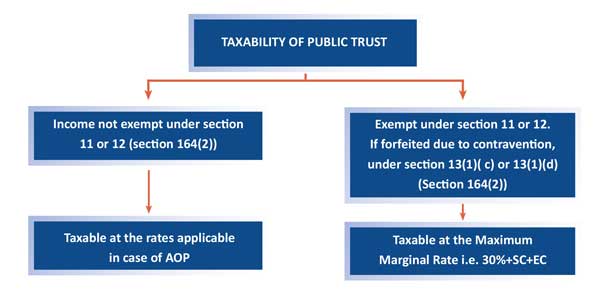

Understanding Public Trust – Overview And Income Tax Implications

A trust is said to be a public trust when it is constituted wholly or mainly for the benefit of the public at large. Public trust are governed by the general law as the Indian Trust Act, 1882 is not applicable to public charitable trust. There is no specific act under which public trust can be established excepting in the state of Gujrat and Maharashtra

Public trust can be established for a number of purposes. In general, trust may register for one or more of the following purposes:-

- Relief to the poor

- Education

- Medical Relief

- Any other object of general public utility

Public trusts may be created inter vivos (transfer of property made during lifetime )or by will. Public trusts are further classified into charitable and religious trusts.

Before starting with details, the meaning of charitable purpose needs to be understood better which has been defined under Section 2(15) of the Income Tax Act, 1961 and stated as under: –

Charitable Purpose includes relief of the poor, education, yoga, medical relief, preservation of environment (including watersheds, forests and wildlife) and preservation of monuments or places or objects of artistic or historic interest, and the advancement of any other object of general public utility.

Provided that the advancement of any other object of general public utility shall not be a charitable purpose if it involves the carrying on of any activity in the nature of trade, commerce or business, or any activity of rendering any service in relation to any trade, commerce or business, for a cess or fee or any other consideration irrespective of the nature or use or application or retention of the income from such activity from such activity unless :

- Such activity is undertaken in the course of actual carrying out of such advancement of any other object of general public utility and

- The aggregate receipts from such activity or activities during the previous year, do not exceeds 20% of the total receipts, of the trust or institution undertaking such activity or activities of that previous

The above section implies that if charitable activity is carried out for advancement of general public utility and during the course of such advancement if any activity in the nature of trade, commerce or business is carried out then such receipts should not exceed 20% of total receipts.

However, if the object of trust is relief of the poor, education, yoga, medical relief, preservation of environment (including watersheds, forests and wildlife) and preservation of monuments or places or objects of artistic or historic interest it will be regarded as a charitable activity regardless of incidental commercial activities.

Each trust or institution when it is registered get a unique identity and various tax exemptions. If a trust wants itself to get the certificate for providing benefit of 80G to the donors in terms of the Income Tax Act, it shall first get itself registered under Section 12AA. The trust or institution may also get various government grants only when it is registered. Such registrations are required to be renewed by taking appropriate approval every 5 years. All existing Charitable trust are required to obtain a fresh registration on or before 31 August 2020

Conditions For Claiming Tax Benefit & Registration Of Trust

Section 12a – Conditions For Applicability Of Section 11 & 12

This Section provides that that the provisions of Section 11 and 12 shall be applicable to a Trust or Institution only if the following conditions are satisfied: –

- The trust or institution has applied for registration to the Commissioner of Income Tax and is registered under Section

- Where subsequent modification has occurred in the objects which do not conform to the conditions of registration, the trust shall mandatorily apply to the Commissioner of Income Tax within a period of thirty days from the date of modification a fresh

- Where the Gross Receipts of the trust exceeds ₹2,50,000 in any previous year, then the accounts of the Trust or Institution shall be audited by a Chartered Accountant and such report shall be furnished within due date of filing of return for the relevant Assessment

The income tax return of the Trust or Institution has been filed within due date as prescribed in Section 139(4C) of the Act.

Section 12aa- Procedure For Registration

- The trust or Institution shall file an application in Form- 10A to the

- The Commissioner on receipt of an application shall call for such documents or information from the trust or institution which he thinks is necessary to establish the facts about the

- genuineness of activities of trust or institution and

- the compliance of requirements of any other law for the time being in force by the trust or institution as are material for the purpose of achieving its objects

- AGer the Commissioner is satisfied about the genuineness & authenticity of the trust and its objects, he shall pass an order in writing for either registering the trust or for refusing to register the Trust or

- Every such order approving or rejecting the application for registration u/s 12AA shall be passed within a period of six months from the end of the month in which application was If no order is passed within the said time period, then the Trust shall be deemed to have been registered. [CIT v. Society for the Promotion of Education, Adventure, Sport & Conservation of Environment [2016] 67 taxmann.com 264].

- The Commissioner may also cancel the registration subsequent to granting registration under Section 12AA if it thinks activities of the trust or institution are not carried in a genuine

Dynamic Changes Introduced By Finance Act 2020 In Registration Process

The amendment state that “trust or an institution have to make application with the Principal Commissioner or Commissioner for registration of the trust as follows:

Within three months from 01st October 2020 seeking for renewal of registration. The application will be disposed of within 3 months of date of receipt of application. The validity of the exemption granted is only for 5 years

Trust registered under section 12AB and the said period is about to expire

At least six months prior to the expiry of the said period.

Trust provisionally registered under section 12AB

At least six months prior to the expiry of the said period or within 6 months of commencements of activities whichever is earlier.

At least 6 months prior to the commencement of the assessment year from which the said registration is sought to be operative.

On modification of the objects of the trust which do not conform to the conditions of the registration.

Within a period of 30 days from the date of the said adoption or modification of the objects.

Understanding Private Trust – Overview And Income Tax Implications

A trust is called a private trust when it is constituted for the benefit of one or more individual who are, or within a given time may be, definitely ascertained. Private trusts are govern by Indian Trust Act, 1882.

The Basic features of private trusts are :

- Beneficiaries are limited and specified.

- Governed by Indian Trust Act,1882

- Beneficiaries are individual or As per Indian Trust Act 1886 “Every person capable of holding property may be a beneficiary. A beneficiary is the person or persons who are entitled to the benefit of any trust arrangement. A beneficiary will normally be a natural person, but it is perfectly possible to have a LLP or company as the beneficiary of a trust. A proposed beneficiary may renounce his interest under the trust by disclaimer addressed to the trustee, or by setting up, with notice of the trust, a claim inconsistent therewith.

- Can be oral or written

Purpose Of Creatio Of Private Trust

During the lifetime of the Se1lor or trust Creator :

- For the benefit of old parents,

- For the benefit of self, spouse, minor/major/disabled children/relatives

- For protecting own interest

- For the purpose of personal charity

- To prevent alienation of personal/ancestral property

– Aƒer death of the Se1lor or trust creator :

- To safeguard the interest of spouse and children

- To protect parents – old age commitments

- For perpetual charity

Who Can Create A Private Trust

But a trust can also be created by or on behalf of a minor with the permission of a principal civil court of original jurisdiction. Apart from an individual, a company, firm, society or association of persons is also capable of creating a trust.

Who Can Be A Trustee

No one is bound to accept trusteeship. Any number of persons of persons may be appointed as trustees as trustees.

Who Can Be A Beneficiary Of A Trust

How Long Can The Trust Operate

Types Of Private Trust

- Revocable Trust – A trust that can be revoked (cancelled) by its settlor at any time during this life

- Irrevocable Trust – A trust will not come to an end until the term / purpose of the trust has been fulfilled.

- Discretionary Trust – An arrangement where the individual shares of the beneficiaries are not known, and the trustees decide the distribution of the income among the beneficiaries. In this case, Settlor lets the trustee decide which beneficiary gets which asset and in what The Settlor only decides beneficiaries. While the beneficiaries are identified, their beneficial interest in the Trust is not ascertained upfront.

- Determinate/ Specific Trusts: The entitlement of the beneficiaries is fixed by the settlor at the time of settlement or by way of a formula, the trustees having little or no discretion

Income Tax Implications Of Private Trust

- The beneficiaries and their shares are determinate and clearly stated in the trust

- In cases where income does not include business income- Section 161(1)

- As per the provisions of the Income tax Act, the tax is levied and recovered from the trustee as a representative assesse in a manner and to the same extent as it would be leviable upon and recoverable from the person represented by him (i.e. the beneficiary).

- The tax authorities have an option and can alternatively make an assessment on the beneficiaries directly, but in no case tax can be collected twice.

- Hence, in cases where a trustee is assessed as a representative assessee, he would generally be able to avail all the benefits / deductions, available to the beneficiary, with respect to that beneficiary’s share of income including the benefit of slabs, initial exempt income, deduction as per law.

- There is no further tax in the hands of the beneficiary on the distribution of income from a trust.

- In this case rate applicable to each beneficiary will be determined and applied to the income from the trust.

- In cases where income include business income- Section 161(1A)

- In this case assessment will be done and trust will pay tax@ 30% plus education cess plus surcharge i.e. at Maximum marginal rate (MMR) *For the AY 2020-21 MMR shall be 42.744% (attracting the highest rate of surcharge of 37%)

- MMR is not applicable if the trust is declared by any person by will exclusively for the benefit of any relative dependent on him for support and maintenance & such trust is the only trust declared by him [proviso to 161(1A)]

- In this case, the shares of the real owners of the income i.e. the beneficiaries is not known.

Where the income of the trust accruing in a particular year is not distributed amongst the beneficiaries, one would not be aware about the income of any particular beneficiary. In such a case, the tax has to be paid by the trustee in representative capacity u/s 164(1). - In case where the income has been distributed to the beneficiaries, tax can be recovered from the trustee u/s 164(1). Further, in such cases, the Courts have held that the tax can be recovered from the beneficiaries But in such a scenario there will no double taxation.

- In cases where income does not include business income and if- Section 164(1)

- None of the beneficiaries has taxable income exceeding maximum amount not chargeable to tax or is a beneficiary in any other trust; or

- The income is receivable under a trust declared by any person by will and such trust is the only trust so declared by him; or

- The income is receivable under a non-testamentary trust created before 03.1970 exclusively for the benefit of relatives of settlor, or member of HUF, who are mainly dependent or member of HUF, who are mainly dependent upon settlor; or

- The income is receivable by trustees on behalf of a provident fund, superannuation fund, gratuity fund, pension fund or any other bona fide fund created by the employer carrying on business or profession for the benefit of his employees

- Then, income of the trust is taxable in the hands of trustees at the rates applicable to an Individual slab rate for AOP is applicable.

- In any other case, income is taxable at the MMR.

- In cases where income includes business income- Proviso to Section 161(1A), Income is taxable at the

- The property transferred to the trust will not be considered as a transfer as per the provisions of Section 47(iii) in the hands of settlor, as any transfer of capital asset under a giG or will or an irrevocable trust is not regarded as transfer and hence not subjected to capital gain tax Hence capital gain will not If a person settles any property under an irrevocable trust, then he is not required to pay any capital gain tax on such transfer

47. Transactions not regarded as transfer.

47. Nothing contained in section 45 shall apply to the following transfers:—

………………………………………….

(iii) any transfer of a capital asset under a giG or will or an irrevocable trust :

Provided that this clause shall not apply to transfer under a giG or an irrevocable trust of a capital asset being shares, debentures or warrants allotted by a company directly or indirectly to its employees under any Employees’ Stock Option Plan or Scheme of the company offered to such employees in accordance with the guidelines issued by the Central Government in this behalf; - In case the nature of the proposed trust is an irrevocable trust, it is squarely covered by provision of Section 47(iii) and therefore no capital gain shall arise in the hands of settlor and further there will be no attraction of Section 50C of Income Tax.

- Accordingly, the recipient e. the beneficiary/ trustee will get the benefit of cost of acquisition of the previous owner as per section 49(1) and even the period of holding would include the period for which such asset was held by the previous owner.

- In case, if the settlor holds the asset as stock in trade, then business loss would be booked in his case. Correspondingly, the recipient would not get the advantage of extended period of holding and cost to the previous owner

Trustee receives the property which is held in a fiduciary capacity for the benefit of the beneficiaries. No gain, profit or rights accrue in the favour of the trustee in his personal capacity. In fact section 51 of the Indian Trust Act, 1882, clearly states that a trustee may not use or deal with the trust-property for his own profit or for any other purpose unconnected with the trust.

Hence, it cannot be said that Trustee acquires a right in rem or any beneficial right in the property which would be sine qua non for being taxed u/s 56(2)(x).

Hence, there will be no tax in the hands of the trustee(s)

As per Section 56(2)(x), in case where sum of money or the property is transferred without consideration by any person, the same shall be chargeable under the head Income from Other sources. The relevant extract of the Section is as under:

- In case of Determinate Trust –

- The property is received by the trustee on behalf of and for the benefit of the beneficiary. Hence, the applicability of the provisions of Section 56(2)(x) may be invoked.

- In situations where the trust is created or established solely for the benefit of relative of the settlor, the taxability will not arise as it will be covered by the exception to Section 56(2)(x).

- In case of Indeterminate trust the beneficiary acquires nothing more than a hope that the discretion would be exercised in his favour. In such a case, there is no question of taxability in the hands of the beneficiary. The provisions of Section 56(2)(x) may be invoked in the hands of the trust.

In any other case

At least one month prior to the commencement of the previous year relevant to the assessment year from which the said approval is sought, and the said fund or trust or institution or university or other educational institution or hospital or other medical institution is approved under the second proviso

Moreover, it is pertinent to note that as provided in earlier before amendment only one-time registration under section 12AA shall be required but now the trust or institution has to, aGer every 5 years apply for mandatory renewal of registration under section 12AB.

Also as per the new proviso inserted in section 11 the trust can either claim an exemption under section 11 & 12 of the Act or under section 10(23C) of the Act. The trust has the discretion to choose only one of the exemptions.

Donation

The trust can apply for separate additional registration under section 80 G to enable the donations received by the trust to get a deduction to the Donor in respect of Donation given to the trust. This application can also be simultaneously be filed along with registration under Section 12AA/12AB.

Statement of donations

Every charitable trusts & specified institutions registered under the Section 80G of the Income Tax Act shall be required to file a statement of donations in the prescribed manner & deduction shall be available to donors based on information relating to donation furnished by such charitable trusts & specified institutions. The entities shall be liable to pay a penalty of INR 250 per day of delay in reporting to file a statement.

The deduction of cash donation under Section 80GGA of the Income Tax Act 1961 shall be restricted to INR 2,000 (earlier INR 10,000).

Taxation Of Income Of Trust

The following Incomes shall not be included in total income of the previous year in receipt of such income:

- 15% of the Income derived from property held under trust even if it is not spent and is accumulated.

- Income to the extent to which it is applied for purposes for which registration was granted.

- Income in the form of voluntary contributions made with a specific direction that they shall form part of the corpus of the trust or institution.

Example:-

Gross Receipts from properties held under trust for religious/charitable purposes |

20,00,000 |

Voluntary Contributions i.e. donations received from donor |

2,00,000 |

Voluntary Contributions i.e. donations received from donors with a specific direction that they should form part of corpus of the trust |

3,00,000 |

Expenditure on activities of religious or charitable nature |

4,00,000 |

Solution: –

Gross Receipts from properties held under trust for religious/charitable purposes |

20,00,000 |

Add: Voluntary Contributions received |

2,00,000 |

22,00,000 |

|

Less: 15% Accumulation |

3,30,000 |

18,70,000 |

|

Less: Expenditure on activities of religious or charitable nature |

4,00,000 |

Total Income |

14,70,000 |

*For the AY 2020-21 MMR shall be 42.744% (a1racting the highest rate of surcharge of 37%)

Points To Be Noted

- The trust shall be liable to obtain a PAN only if

- If the total income exceeds maximum amount which is not chargeable to tax.

- A charitable trust who is required to furnish return under Section 139(4A)

- Every person who intends to enter into specified financial transactions in which quoting of PAN is mandatory

Even though the trust is not covered in any of the above criteria we suggest that Trust shall apply for PAN voluntary. Further Trust should also obtain a TAN considering its future activities and tax compliances.

- For a trust to be eligible for making an application to obtain a FCRA certificate following criteria should be satisfied:

- The trust should be registered under the Indian Trusts Act, 1882 or under Section 8 (erstwhile Section 25) of the Companies Act, 2013;

- The trust should be in existence for at least 3 years and has undertaken reasonable activity in its chosen field for the benefit of the society for which the foreign contribution is proposed to be utilized.

- The trust should have spent at least 10,00,000/- over the last 3 years on its aims and objects, excluding administrative expenditure.

- Statements of Income & Expenditure, duly audited by CA, for the last 3 years are to be submitted to substantiate that it meets the financial parameter.

- If in any previous year, the charitable or religious trust fails to apply its 85% of its total receipts towards the objects then such shortfall of receipts shall be taxable in the hands of the However if :

- The reason for non-application of the receipt of income is that the whole or any part of the income has not been received during that year or

- The amount has been accumulated or set apart for application for specified such purposes in India in the future.

Then such receipt shall deemed to have being applied for the purpose of Sec-11. However for receipt mentioned in former point-1 (a) shall have to be applied in the year in which it is actually received. Further for claiming any amount as set-apart in terms of 1 (b), a prescribed form has to be furnished to the concerned officer within the due date of filing the return.

- Also, the trust or the institution has an option to accumulate or set apart, either in whole or in part, for application to such purposes in India, such income so accumulated or set apart shall not be included in the total income of the previous year of the person in receipt of the income, provided the following conditions are complied with namely: –

- The trust shall file a Form 10 with the Assessing Officer specifying the purpose and period (which in no case shall exceed 5 years) within the due date specified under Section 139(1).

- The money so accumulated or set apart should be invested in the modes specified under Section 11(5).

- The Income tax return of the trust or institution is furnished within due date mentioned under Section 139.

- Anonymous donations are donations which taxpayers make to a place or person where proper records are not maintained. Exemptions are allowed up to 5% of the total donations or Rs.1,00,000, whichever is higher, rest are taxed at the rate of 30%. However, donations offered to a trust which is entirely religious in nature will be provided with a complete exemption. If the anonymous donation is received for educational purposes, and the Trust operates the same, such donations would be taxable.

- Further, as per the provisioning of Section 11(7), where a trust or an institution has been granted registration under Section 12AA and the said registration is in force for any previous year, then the trust cannot claim any exemption under any provision of Section 10 except under Section 10(1) and Section 10(23C).

- Furthermore, the provisions of Section 40(a)(ia) [dis-allowance on account of non deduction of TDS] and Section 40A(3) [disallowance of expenditure incurred in cash exceeding INR 10,000 per person in a day] and Section 40(3A) [dis-allowance of payment made to the outstanding Liability in cash exceeding INR 10,000 per cash] shall mutatis mutandis apply as they apply in computing the income chargeable under the head “Profit and gains of business and profession”.

- The tax rates applicable to the trust are the same as that to an individual.

The income from trust income will be taxable in the hands of the settlor from inception in terms of section 61

Benefits of Forming a Private Trust

Purpose |

Jurisdiction |

Problems? |

Reduce taxation on assets & Income Jurisdiction |

|

Countries have introduced tax avoidance legislation to combat the use of offshore structures to avoid tax |

Purpose |

Benefits |

Possible Beneficiaries? |

Allowing individual family memebers to benefit from assets without having direct ownership or management of them |

|

|

Purpose |

Unknowning Parties |

Problems? |

Create an entity which holds assets but is unknown to certain people |

The following entities may not be aware of the trust full details:

|

Some jurisdictions call for the registration of certain trusts. In India the trust are not required to be registered. The Companies Act require disclosure of beneficial interest by filing a form BEN |

Purpose |

Benefits |

Problems? |

|

|

The assets are held by the trustee which can be transferred and changed only through careful management to ensure that probate does not arise. |

Purpose |

Benefits |

Problems? |

To Protect assets from future and present unknown creditors |

Overcome attempts to freeze assets in case of tax demands on beneficiaries and or trustee in individual their capacity |

Bankruptcy laws can make previous transfers void or voidabe - Only in case of fraudulent transfer |

How we as an INMACS Can Contribute

- Tax Planning, Succession planning and corporate structuring

- We can provide you with our assistance in getting your trust registered under respective stature in India or overseas.

- We can guide you in preparing and filing of Income Tax Return of the Trust or Institution.

- We can help you in fulfilling the various statutory compliance related to filing of various prescribed forms for Trust or Institutions under different statue-like Income Tax Act.

- We can provide our expertise in accounting, wealth Management, Auditing the Account of the Trust or Institution whether its private trust or public trust.

- We can help claim the deduction of the donation made to your Trust, Institute, Society, Section 8 Company under the Act.

- We can assist you in setting up of your private trust for the purpose of securing the future of your closed ones.

- We can provide you with services of Professional Trustees in India and overseas.