Applicability Of Income Tax Return Form and Due date for filing ITR

ITR Form |

Particulars |

Due Dates |

||

ITR 1 |

|

31st July, 2019 |

||

ITR 2 |

Any Individuals and HUFs not having income from Profits and Gains from Business or Profession. |

31st July, 2019 |

||

ITR 3 |

Any individuals and HUFs having income from Profits and Gains of Business or Profession.

|

31st July, 2019 (30th September, 2019 in case Audit is Required) |

||

ITR 4 |

Any Resident Individual (ROR), HUFs, Firms (Other than LLP) declaring income on presumptive basis under the head Business and Profession which is computed as per:-

WHO CANNOT USE ITR-4

|

31st July, 2019 (30th September, 2019 in case Audit is Required) |

||

ITR 5 |

Person required to file Form 5:-

|

31st July, 2019 (30th September, 2019 in case Audit is Required) |

||

ITR 6 |

Companies other than companies claiming exemption u/s 11 |

30th September, 2019 |

||

ITR 7 |

Persons (including companies):-

|

Major Changes in ITR Forms

- Tax deduction and collection account number (TAN) of employer is mandatory if tax is deducted.

- Separate Reporting of all Deductions u/s 16 is required, namely:

- Standard deduction u/s 16(ia);

- Entertainment allowance u/s 16 (ii);

- Professional tax u/s 16(iii)

- Name of Buyer;

- PAN of Buyer is mandatory if the tax is deducted u/s 194IA;

- Percentage share and amount, if more than one buyer;

- Address of Property;

- PIN Code.

- Full Value of Consideration Received;

- Cost of Acquisition without Indexation;

- Fair market value of capital asset as on 31.01.2018;

- Cost of Improvement without Indexation;

- Expenditure Incurred related to transfer;

- Investment made u/s 54F.

2.3 Net Agricultural Income exceeds Rs. 5 Lakhs [ITR 2, 3, 5, 6]

New form requires additional details if the income from agricultural activities exceeds Rs. 5 lakhs. The following information is required to be disclosed:-

- Name of the district along with pin code in which agricultural land is

- Measurement of land in

- Whether the land is owned or held on lease

- Whether the land is irrigated or rain-fed.

In respect of income which is not chargeable to the tax taking the benefit of Double Taxation Avoidance Agreement, new ITR forms require following additional information:-

- Amount, Nature and Head of Income;

- Country name & Code;

- Article of DTAA;

- Whether TRC obtained

Profit and Loss Schedule is amended and is divided into following three new parts:

- Manufacturing Account;

- Trading Account;

- Profit & Loss Account.

Thus, if assessee is engaged in Manufacturing Activities then he shall provide

- Cost of Goods Sold through Manufacturing Account;

- Gross Profit through Trading Account;

- Net Profit through Profit and Loss Account.

Manufacturing account is not meant for service providers and traders. Hence, they can start directly from trading account.

In case Assessee earns Income from Speculative Activities, following information is required to be reported in that schedule:-

- Turnover from speculative activities

- Gross profit, Expenditure

- Net income from speculative activities.

In case, Assessee has opted for Presumptive Scheme u/s 44AD/44ADA/44AE- Business name, Code & Description of business needs to be disclosed.[ITR 3,4,5,6]

In case assessee has claimed bad debts of an amount exceeding Rs. 1 Lakhs, it is mandatory to furnish name and address of the debtor in case PAN of such debtor is not available.

Under new ITR Form, GSTIN Number and Annual value of outward supplies as per GST return filed by assesse is to be disclosed.

The following information is required to be furnished:-

- Name of the firm;

- PAN of the firm;

- Whether the firm is liable for tax audit?

- Whether the firm is liable for transfer pricing audit?

- Profit sharing ratio in firm

- Share of profit from firm

- Capital balance as on 31st March of the previous year in the firm

With effect from Assessment Year 2019-20, Rule 12 of the I-T Rules has been amended to exclude sections 139(4E) and 139(4F) from the list which are applicable to Business Trust and Investment Funds respectively, which means these trust will not be able to file ITR-7. Therefore, such assesses have to use ITR-5 to file their returns.

Reporting requirements in respect of foreign assets has been increased. Now, the following additional information is required to be disclosed:-

- Besides Foreign Bank Accounts, Details of Foreign Depository Account are

- Details of foreign custodial accounts

- Details of foreign equity and debt interest held in equity, financial interest in any entity (including any beneficial interest), any immovable property held at anytime during the relevant year

- Details of foreign cash value insurance contract or annuity contract

- Details of other capital assets held at any time during the relevant

- Details of account in which assessee is having any signing authority

- Details of any trust incorporated outside India in which assessee is trustee, beneficiary or settler.

Foreign Companies are required to report the following information about their immediate and ultimate parent company:-

- Name and Address of Parent

- Country of

- PAN (if allotted).

- Tax Identification or Unique Identify No. of the parent company as per its country of residence

The following information regarding eligible start-ups approved by DPIIT is required:

- Registration allotted by DPIIT

- Certificate Number of the certificate received from Inter-Ministerial

- Date of filing of form 2 with DPIIT

To track issue of shares by start-ups, “Schedule SH 2”has been incorporated in ITR wherein start-ups are required to provide the following information about the shareholders and the share applicant (in case allotment is pending):-

- Name, PAN, Category of shareholder;

- Type of share

- Date of allotment/Date of application of shares;

- Number of shares held/No. of shares applied for by the shareholder;

- Face value, Issue Price, Paid up per share;

- Share application money in case allotment is pending;

- Share premium.

Further, in case a person, who was a shareholder at any time during the previous year, but ceases to be a shareholder at the end of the previous year, following additional information are required to be furnished:-

- Date on which he ceased to be shareholder;

- Mode of cessation;

- PAN of new shareholder in case of transfer.

In “Schedule SH 1” wherein Unlisted Companies (other than start-ups) are required to provide the following information about the shareholders and the share applicant (in case allotment is pending):-

- Name, PAN, Category of shareholder;

- Type of share

- Date of allotment/Date of application of shares;

- Number of shares held/No. of shares applied for by the shareholder;

- Face value, Issue Price, Paid up per share;

- Share application money in case allotment is pending;

- Share premium.

Further, in case a person, who was a shareholder at any time during the previous year, but ceases to be a shareholder at the end of the previous year, following additional information are required to be furnished:-

- Date on which he ceased to be shareholder;

- Mode of cessation;

- PAN of new shareholder in case of transfer.

A new Schedule AL-1 has been inserted which mandates the Un-listed Companies (other than start-ups) to furnish the following information:-

- Land and Building appurtenant there to, or both, being a residential house;

- Land and Building or both not being in the nature of residential house;

- Unlisted equity shares held, transferred or acquired during the year;

- Other securities held, transferred or acquired during the year;

- Capital Contribution to other entity;

- Loan & Advances to any other concern;

- Motor Vehicle, AircraG, Yacht or other modes of transport acquired;

- Jewellery, Archaeological Collections, Drawings, Paintings, Sculptures, any work of art or bullion acquired;

- Loans, Deposits and Advances taken from a person other than financial institution.

Unlisted companies are required to provide details of natural persons who were ultimate beneficial owners, directly or indirectly, of shares holding not less than 10% of the voting power at any time of the previous year in General Information.

Under the Income Tax Act, beneficial owner means person who has paid for an asset (directly or indirectly) for immediate or future benefit (directly or indirectly) of himself or any other person

This is a new provision introduced vide Finance Act, 2017 as an anti-abuse measure w.e.f. AY 2018-19. This will compel the companies (and other assesses) to evaluate applicability of section 56(2)(x) and make appropriate disclosure in the return.

The disclosures are with regards to amount received without or inadequate consideration and stamp duty or fair market value of the property depending upon the asset

- Changes have been made so as to reflect full value consideration in accordance with provisions of section 50CA of the Act, both in case of short-term and long-term capital

- Section 50CA was inserted by the Finance Act, 2017 e.f. AY 2018-19, as a part of anti-abuse measures. It deals with the fair value of assets being unlisted shares transferred at nil/inadequate consideration for the purpose of computation of capital gains (Similar to that of section 50C).

- New ITR Forms require the taxpayer to provide figures of actual sales consideration and FMV as determined by a Merchant Banker or CA and it has been made mandatory to obtain a valuation The new ITR Forms require assessees to provide the information regarding actual sale consideration and FMV in respect of unlisted shares.

- This could be the reason why details of capital gains from transactions to which section 50CA of the Act is applicable, have been asked for separately in the

- The process of determination of fair market value in terms of Rule 11UAA needs to be initiated in advance.

-

Profits and gains of business or profession

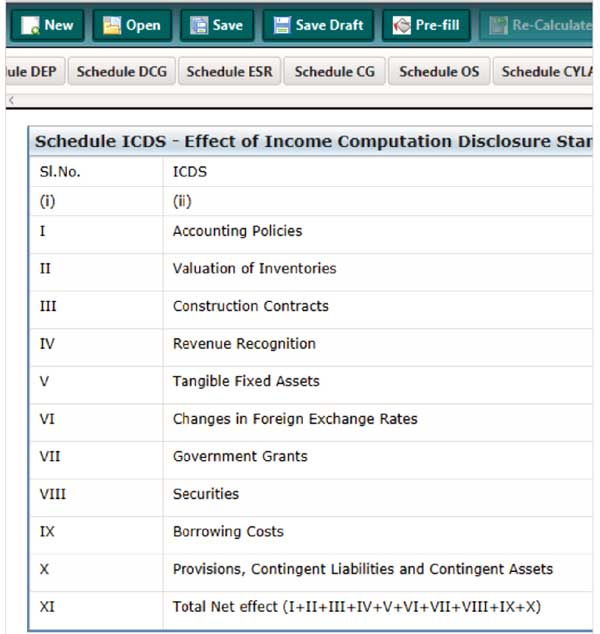

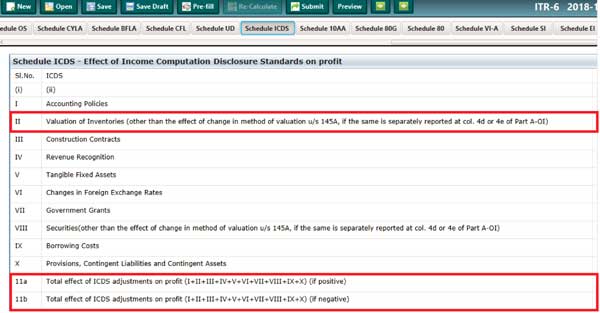

Schedule ICDS requires disclosure of effect of each ICDS on the profits. Accordingly, the aggregation of such ICDS impact in “positive” and “negative” could be with the objective of obtaining (auto collection) some statistical data.

- Effects on the profits and losses due to ICDS have to be reported in two categories instead of a consolidated figure − Increase in profit or decrease in loss due to deviation as per ICDS − Decrease in profit or increase in loss due to deviation as per ICDS

- In method of valuation of closing stock also, effects due to deviation from valuation method under section 145A have to be reported in two categories − Increase in profit or decrease in loss − Decrease in profit or increase in loss

- The total effect of ICDS adjustments on profit is bifurcated into positive effect and negative effect instead of net effect

Income Computation Disclosure Standard (ICDS) ITR – 3 and 6

-

Details of registration under any other law are also required to be reported are as follows:-

- Law under which registered;

- Date of registration or approved;

- Approval/Notification/Registration Number;

- Approving/ Registering Authority

-

- Income derived from the property/income earned during previous year;

- Income deemed as application in any preceding year;

- Income of earlier years up to 15% accumulated or set apart;

- Borrowed fund;

- Others

- Now the trusts are liable to furnish the details of source of fund to meet capital and revenue expenditure incurred by them in the following manner:-

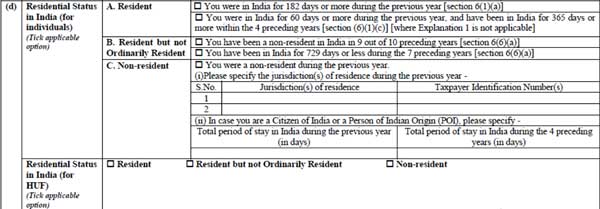

General Changes ITR Forms:-

- Name of

- PAN of

- Whether its shares are listed or

- DIN

- Name of

- PAN of

- Of Shares and cost of acquisition held as on 01st April 2018.

- Of Shares, face value, issue price and date of shares acquired during the year.

- No of Shares and sale consideration transferred during the

- No of Shares and cost of shares held as on 31st March, 2019

- Interest from Saving Account;

- Income from Deposit (Bank/Post office/ Cooperative Society);

- Interest from Income Tax Refund;

- Family Pension;

- Any Others.

required to be furnished:-

- Name and address of donee;

- PAN of donee;

- Amount of donation made in Cash and in other mode

The new detailed ITR forms issued will surely add up to the details available with department and enhance the effectiveness of department while processing the returns. This can also be concluded that the aim of the department with new disclosures is to gather the data. These data will help the authorities to cross check the details furnished by the taxpayers and will lead to a more transparent economy.

How Inmacs can help:

- Carefully filing of returns of income duly disclosing the requisite information;

- Avoid penalty which can be levied due to non-furnishing of details;

- Analysing the details required to be filed in the return;

- Precautionary cross-checking of details with other available information