Sequence of Events

- Janata Curfew – 14 Hrs – on Sunday 22nd March

- Monday and Tuesday also most states observed Locked Down or Curfew based on local administration or State Government Orders

- 21 Day – LockDown from Midnight of 24th March – i.e. from 25th March 2020 to 14th March 2020

- Announcements by

- Finance Minister – 2 Tranches – 24th and 26th March 2020

- Reserve Bank of India – 27th March 2020

- MCA, NCLT, IBBI, etc

Finance Minister announces several relief measures relating to Statutory and Regulatory compliance matters across Sectors in view of COVID-19 Outbreak 24 -3-2020

Income Tax

- Extend last date for income tax returns for (FY 18-19) from 31st March, 2020 to 30th June, 2020.

- Aadhaar-PAN linking date to be extended from 31st March, 2020 to 30th June, 2020.

- Vivad se Vishwas scheme – no additional 10% amount, if payment made by June 30, 2020.

- Due dates for issue of notice, intimation, notification, approval order, sanction order, filing of appeal, furnishing of return, statements, applications, reports, any other documents and time limit for completion of proceedings by the authority and any compliance by the taxpayer including investment in saving instruments or investments for roll over benefit of capital gains under Income Tax Act, Wealth Tax Act, Prohibition of Benami Property Transaction Act, Black Money Act, STT law, CTT Law, Equalization Levy law, Vivad Se Vishwas law where the time limit is expiring between 20th March 2020 to 29th June 2020 shall be extended to 30th June

- For delayed payments of advanced tax, self-assessment tax, regular tax, TDS, TCS, equalization levy, STT, CTT made between 20th March 2020 and 30th June 2020, reduced interest rate at 9% instead of 12 %/18 % per annum ( i.e. 0.75% per month instead of 1/1.5 percent per month) will be charged for this period. No late fee/penalty shall be charged for delay relating to this period.

- Necessary legal circulars and legislative amendments for giving effect to the aforesaid relief shall be issued in due course.

Goods & Services Tax / Indirect Tax

- Those having aggregate annual turnover less than Rs. 5 Crore Last date can file GSTR-3B due in March, April and May 2020 by the last week of June, 2020. No interest, late fee, and penalty to be charged.

- Others can file returns due in March, April and May 2020 by last week of June 2020 but the same would attract reduced rate of interest @9 % per annum from 15 days after due date (current interest rate is 18 % per annum). No late fee and penalty to be charged, if complied before till 30th June 2020

- Composition Dealers

- Date for opting for composition scheme is extended till the last week of June, 2020.

- Further, the last date for making payments for the quarter ending 31st March, 2020 and filing of return for 2019-20 by the composition dealers will be extended till the last week of June, 2020.

- Date for filing GST annual returns of FY 18-19, which is due on 31st March, 2020 is extended till the last week of June 2020.

- Due date for issue of notice, notification, approval order, sanction order, filing of appeal, furnishing of return, statements, applications, reports, any other documents, time limit for any compliance under the GST laws where the time limit is expiring between 20th March 2020 to 29th June 2020 shall be extended to 30th June

- Necessary legal circulars and legislative amendments to give effect to the aforesaid GST relief shall follow with the approval of GST Council.

- Payment date under Sabka Vishwas Scheme shall be extended to 30th June, 2020. No interest for this period shall be charged if paid by 30th June, 2020.

Customs Duty / Indirect Tax

- 24X7 Custom clearance till end of 30th June, 2020

- Due date for issue of notice, notification, approval order, sanction order, filing of appeal, furnishing applications, reports, any other documents etc., time limit for any compliance under the Customs Act and other allied Laws where the time limit is expiring between 20th March 2020 to 29th June 2020 shall be extended to 30th June 2020.

Financial Services

- Relaxations for 3 months Debit cardholders to withdraw cash for free from any other banks’ ATM

- For 3 months

- Waiver of minimum balance fee

- Reduced bank charges for digital trade transactions for all trade finance consumers

Corporate Affairs

- No additional fees shall be charged for late filing during a moratorium period from 01st April to 30th September 2020, in respect of any document, return, statement , required to be filed in the MCA-21 Registry, irrespective of its due date, which will not only reduce the compliance burden, including financial burden of companies/ LLPs at large, but also enable long-standing non-compliant companies/LLPs to make a ‘fresh start’;

- The mandatory requirement of holding meetings of the Board of the companies within prescribed interval provided in the Companies Act (120 days), 2013, shall be extended by a period of 60 days till next two quarters e., till 30th September;

- Applicability of Companies (Auditor’s Report) Order, 2020 shall be made applicable from the financial year 2020-2021 instead of from 2019-2020 notified This will significantly ease the burden on companies &their auditors for the year 2019-20.

- As per Schedule 4 to the Companies Act, 2013, Independent Directors are required to hold at least one meeting without the attendance of Non-independent directors and members of management. For the year 2019-20, if the IDs of a company have not been able to hold even one meeting, the same shall not be viewed as a violation.

- Requirement to create a Deposit reserve of 20% of deposits maturing during the financial year 2020-21 before 30th April 2020 shall be allowed to be complied with till 30th June 2020.

- Requirement to invest 15% of debentures maturing during a particular year in specified instruments before 30th April 2020, may be done so before 30th June 2020.

- Newly incorporated companies are required to file a declaration for Commencement of Business within 6 months of incorporation. An additional time of 6 more months shall be allowed.

- Non-compliance of minimum residency in India for a period of at least 182 days by at least one director of every company, under Section 149 of the Companies Act, shall not be treated as a violation.

- Due to the emerging financial distress faced by most companies on account of the large-scale economic distress caused by COVID 19, it has been decided to raise the threshold of default under section 4 of the IBC 2016 to Rs 1 crore (from the existing threshold of Rs 1 lakh). This will by and large prevent triggering of insolvency proceedings against MSMEs. If the current situation continues beyond 30th of April 2020, we may consider suspending section 7, 9 and 10 of the IBC 2016 for a period of 6 months so as to stop companies at large from being forced into insolvency proceedings in such force majeure causes of default.

- Detailed notifications/circulars in this regard shall be issued by the Ministry of Corporate Affairs separately

Department of Fisheries

- All Sanitary Permits (SIPs) for import of SPF Shrimp Broodstock and other Agriculture inputs expiring between 01.03.2020 to 04.2020 extended by 3 months

- Delay upto 1 month in arrival of consignments to be condoned.

- Rebooking of quarantine cubicles for cancelled consignments in Aquatic Quarantine Facility (AQF) Chennai without additional booking charges

- The verification of documents and grant of NOC for Quarantine would be relaxed from 7 days to 3 days

Department of Commerce

Extension of timelines for various compliance and procedures will be given. Detailed notifications will be issued by the Ministry of Commerce

Facilitation measures undertaken by Regulatory Authorities

-

In the wake of pandemonium caused by the spread of the COVID-19 virus, temporary relaxations in compliance requirements and other facilitation measures are very much needed.

The following measures have been undertaken by both,

- the Ministry of Corporate Affairs (MCA) and

- the Securities and Exchange Board of India (SEBI) to provide relief to the stakeholders

Measures undertaken by the Ministry of Corporate Affairs

Measures |

Implication |

No additional filing fees shall be charged for late filing during a moratorium period from 01st April to 30th September 2020, in respect of any document, return, statement etc., required to be filed in the MCA-21 Registry, irrespective of its due date. |

No additional filing fees shall be charged for late filing during a moratorium period from 01st April to 30th September 2020, in respect of any document, return, statement etc., required to be filed in the MCA-21 Registry, irrespective of its due date. |

No additional filing fees shall be charged for late filing during a moratorium period from 01st April to 30th September 2020, in respect of any document, return, statement etc., required to be filed in the MCA-21 Registry, irrespective of its due date. |

As a one-time relaxation the gap between two consecutive meetings of the Board may extend to 180 days till the next two quarters, instead of 120 days as required in the Companies Act, 2013. |

Meetings through video conference – As per rule 4 of the Companies (Meetings of Board and its Powers) Rules, 2014 read with the Companies Act, 2013, the following matters cannot be dealt with in any meeting held through video conferencing or other audio-visual means:

approval of annual financial statements

approval of the Board’s report approval of the prospectus

audit committee meetings for consideration of financial statements; and approvals relating to amalgamations, merger, demerger, acquisition and takeover.

On March 19, 2020, Ministry of Corporate Affairs amended the above rules, as per which, from the date of the commencement of the Companies (Meetings of Board and its Powers) Amendment Rules, 2020 till June 30, 2020, meetings on the above-mentioned matters may also be held through video- conferencing or other audio visual means.

Measures |

Implication |

CARO extended: Applicability of Companies (Auditor’s Report) Order, 2020(CARO) shall be made applicable from the financial year 2020-2021 instead of from 2019-2020 notified earlier. |

This will significantly ease the burden on companies & their auditors for the financial year 2019-20. |

Independent Directors’ meeting: As per Schedule IV to the Companies Act, 2013, Independent Directors are required to hold at least one meeting without the attendance of Non-independent directors and members of management. For the year 2019-20, if the IDs of a company have not been able to hold even one meeting, the same shall not be viewed as a violation. |

IDs, however, may share their views amongst themselves through telephone or e-mail or any other mode of communication, if they deem it to be necessary. |

- Deposit repayment reserve: Requirement to create a Deposit repayment reserve of 20% of deposits maturing during the financial year 2020-21 before 30th April 2020 shall be allowed to be complied with till 30th June 2020

- Deposit repayment investment: Requirement to invest 15% of debentures maturing during a particular year in specified instruments before 30th April 2020 may be done so before 30th June 2020.

- Commencement of Business: Newly incorporated companies are required to file a declaration for Commencement of Business within 6 months of incorporation in the form INC-20A. An additional time of 6 more months shall be allowed.

- Mandatory resident Director: Non-compliance of minimum residency in India for a period of at least 182 days by at least one director of every company, under Section 149 of the Companies Act, shall not be treated as a violation for the financial year 2019-20.

- Spending CSR funds for COVID-19 is now eligible as CSR activity – On 23.03.2020, MCA vide its circular allowed companies to use their Corporate Social Responsibility (CSR) spending on measures to fight COVID-19.

Relaxations under

The Insolvency and Bankruptcy Code, 2016

- Due to the emerging financial distress faced by most companies on account of the large-scale economic distress caused by COVID-19, it has been decided to raise the threshold of default under section 4 of the IBC 2016 to 1 crore (from the existing threshold of Rs 1 lakh).

- This will also apply on the existing filed cases which are pending for consideration.

Relaxation from compliance with certain provisions of

Extension of timelines for filings such as:

S. No |

Regulation and associated filing |

Filing due date |

Extended date |

1 |

Regulation 7(3) - certificate on share transfer facility |

April 30, 2020 |

May 31, 2020 |

2 |

Regulation 13(3) -Statement of Investor complaints |

April 21, 2020 |

May 15, 2020 |

3 |

Regulation 24A - Secretarial Compliance report |

May 30, 2020 |

June 30, 2020 |

4 |

Regulation 27(2) Corporate Governance report |

April 15, 2020 |

May 15, 2020 |

5 |

Regulation 31- Shareholding Pattern |

April 21, 2020 |

May 15, 2020 |

6 |

Regulation 33- Financial Results |

May 15, 2020 (Quarterly) May 30, 2020 |

June 30, 2020 June 30, 2020 |

7 |

Regulation 40(9)-PCS Certificate on timely issue of share certificate |

April 30, 2020 (Half Yearly) |

May 31, 2020 |

8 |

Regulation 44(5)- Holding AGM by top 100 listed entities by market cap for financial year 2019-20 |

August 31, 2020 (Annual) |

Sept 30, 2020 |

SEBI has decided to grant the following relaxation from compliance stipulations specified under the SEBI LODR:

- Relaxation of time gap between two Board and Audit Committee meetings:

The Board of Directors and the Audit Committee of a listed entity have been exempted from maintaining time gap of 120 days between two Board Meetings to be held between the period December 1, 2019 and June 30, 2020.

However, the board of directors / Audit Committee shall ensure that they meet at least four times a year, as stipulated under regulations 17(2) and 18(2)(a) of the LODR.

Unaudited Financials filing: Extension of timeline for issuance and filings for issuers who have listed / propose to list their Non-Convertible Debentures (NCDs) / Non-Convertible Redeemable Preference Shares (NCRPS)/ Commercial Paper(s).

Implication: companies proposing to make public issue of debt securities, and issuers who intend to get their CPs listed are required to give the audited financials in the offer document, which are not older than 6 months from the date of prospectus. However compliant listed entities are allowed to disclose unaudited financials with limited review report, instead of audited financials, for the stub period.

SEBI has decided to grant the following relaxation from compliance stipulations specified under the SEBI LODR:

Conduct of Committee meeting: –

S. No |

Regulation |

Requirement |

Frequency |

Due Date |

Extended Date |

1 |

Regulation 19(3A) |

The nomination and remuneration committee shall meet at least once in a year |

Yearly |

March 31, 2020 |

June 30, 2020 |

2 |

Regulation 20(3A) |

The Stakeholders Relationship committee shall meet at least once in a year |

Yearly |

March 31, 2020 |

June 30, 2020 |

3 |

Regulation 21(3A) |

The Risk Management Committee shall meet at least once in a year |

Yearly |

March 31, 2020 |

June 30, 2020 |

SEBI has decided to grant the following relaxation from compliance stipulations specified under the SEBI LODR:

Relaxation of the operation of the SEBI circular on Standard Operating Procedure dated January 22, 2020-

SEBI vide circular no. SEBI/HO/CFD/CMD/CIR/P/2020/12 dated January 22, 2020 issued the Standard Operating Procedure(SoP)on imposition of fines and other enforcement actions for non-compliances with provisions of the LODR, the effective date of operation of which is for compliance periods ending on or after March 31, 2020. The said circular dated January 22, 2020 shall now come into force with effect from compliance periods ending on or after June 30, 2020. It may be noted that the SoP circular dated May 03, 2018 would be applicable till such date.

Publication of advertisements in the newspapers: –

Regulation 47 of the LODR requires publishing, in the newspapers, information such as notice of the board meeting, financial results etc. It has been brought to the notice of SEBI that some newspapers are not bringing their print versions for a limited period; some newspapers that are still printing are not accepting a ‘e-copy’ of the information to be published which acts as a challenge in ensuring compliance with this regulation. Hence it has been decided to exempt publication of advertisements in newspapers as required under regulation 47 for all events scheduled till May 15, 2020.

due to coronavirus On 23.03.2020, CCI has vided its notice announced that following shall remain suspended until 31st March 2020

- All filings in relation to Section 3 and Section 4 of the Competition Act, 2002

- All notifications in relation to combination under Section 6 and 20 of the Act;

- All other filings, submissions and proceedings under the Act and regulations made thereunder, including those before the Director-General and

- Pre-filing Consultation

Earlier, CCI vide its Circular dated 17th March 2020, has adjourned matters listed from hearing (excluding urgent matters, if any) till March 31, 2020.

Also, the functioning of the Supreme Court from March 16, 2020 shall be restricted to urgent matters with such number of benches as may be found appropriate. The lawyers who are going to act in the matter, i.e. either for arguments or for making oral submissions or to assist will be permitted in the court room along with 1 (one) litigant only.

- All NCLT benches shall remain closed from 23.03.2020 till 14.04.2020 for the purpose of judicial work;

- As to the unavoidable urgent matters, on application by aggrieved through email to the Registry,

- As regards to the IBC, 2016 matters extension of time, approval of resolution plan and liquidation will not be construed as urgent matters.

The MPC advanced its meeting scheduled to be held on 3rd April,2020 to 27th March,2020 taking care of the macroeconomic and financial conditions of the Indian economy affected by the Covid-19 pandemic.

Liquidity Rate Measures:

- Reduce the Policy Repo Rate under the liquidity adjustment facility (LAF) by 75 basis points to 40% from 5.15% with immediate effect;

- Accordingly, the Marginal Standing Facility (MSF) rate and the Bank Rate stand reduced to 65% from 5.40%;

- further, consequent upon the widening of the LAF corridor as detailed in the accompanying Statement on Developmental and Regulatory Policies, the Reverse Repo Rate under the LAF stands reduced by 90 basis points to 4.0%.

- CRR cut by 100 bps to 3% of NTDL with effect from 28th March 2020

- The MPC also decided to continue with the accommodative stance as long as it is necessary to revive growth and mitigate the impact of coronavirus (COVID-19) on the economy while ensuring that inflation remains within the target.

- Total liquidity measure introduced today equals to 2% of GDP, which will infuse Rs. 3.74 lakh cr. liquidity into the financial system.

The MPC advanced its meeting scheduled to be held on 3rd April 2020 to 27th March 2020 taking care of the macroeconomic and financial conditions of the Indian economy affected by the Covid-19 pandemic.

Liquidity Enhancement Instruments:

- Auctions of long-term repo operations (LTRO) of 3 years tenure up to 1 lakh cr. at a floating rate linked to policy rate.

- First auction for LTRO to be conducted on 27th March,2020.

- Investments to be classified as HTM, even in excess of 25% requirements.

- Total liquidity infused- Rs. 2.8 lakh cr. via instruments equal to 1.4% of GDP.

The MPC advanced its meeting scheduled to be held on 3rd April,2020 to 27th March,2020 taking care of the macroeconomic and financial conditions of the Indian economy affected by the Covid-19 pandemic.

Easing measures for Banking and NBFC Sector:

- NSFR required to be introduced on 1st April 2020 to be deferred to October 2020.

- Banks and Lending institutions allowed a 3-month moratorium on term loan EMI instalments outstanding on 1st March,2020.

- Banks and Lending institutions allowed 3-month deferment of working capital cycle and deferment not to be treated as NPA.

- Incremental CCB implementation deferred from 30th March 2020 to 30th Sept 2020.

The MPC advanced its meeting scheduled to be held on 3rd April 2020 to 27th March 2020 taking care of the macroeconomic and financial conditions of the Indian economy affected by the Covid-19 pandemic.

Liquidity Status of Indian economy as on 27th March 2020:

- Systematic liquidity surplus averaged 2.86 lakh cr. up to 25th March 2020.

- RBI had undertaken unconventional operations called as ‘operational twist’ involving the simultaneous sale of short-term government securities worth Rs. 28,276 and purchase of long-term securities worth Rs. 40,000 Cr injecting net amount of Rs. 11,274 Cr.

- 5 LTROs have been conducted so far up To 1.25 lakh cr.

- Two sell-buy swap operations conducted on March 16 and 23 to infuse USD 71billion.

- Open market purchase operations of 10,000 Cr. on March 20 and Rs. 15,000 Cr. on March 24 and 26 each.

RBI Governor on Current State of the Economy:

- Banking Sector safe and sound.

- Depositors of commercial banks including private banks not to worryabout safety of funds.

- Offshore Rupee NDF Market growing rapidly.

- Macroeconomic fundamentals of Indian economy are also sound and stronger than before than that of 2008-09 global financial crisis but growth recovery outlook for 2020 has been dashed owing to the COVID- 19 pandemic.

- The Second Advance Estimates of the National Statistics Office released in February 2020 implied real GDP growth of 4.7% for Q4FY20 with an annual estimate of 5% for the whole year, which is now at risk owing to the pandemic.

- A pick-up in manufacturing and electricity generation pulled industrial production into positive territory in January 2020 after intermittent contraction and/or lacklustre activity over the past five months; however, more data will need to be watched to assess whether the recent uptick will endure in the face of COVID-19. Meanwhile, most service sector indicators for January and February 2020 moderated or declined.

- Outlook for agriculture and allied activities the only silver lining for domestic economy on the supply side, with food grains output being 292 million tonnes, being 2.4% higher than a year ago.

- In the external sector, merchandise exports expanded in February 2020 after posting six consecutive months of contraction. Import growth also moved into positive territory after eight months of continuous decline. Consequently, the trade deficit widened marginally on a year-on-year basis although it was lower than its level a month ago. On March 12, the Reserve Bank released balance of payments data which showed the current account having moved to near balance in Q3:2019-20 with a deficit of only 0.2% of GDP.

- On the financing side, net FDI inflows at US$ 37.8 billion during April- January 2019-20 were substantially higher than a year ago. Portfolio investment recorded net outflows of US$ 5.2 billion during 2019-20 (up to March 25), down from US$ 6.6 billion a year ago. India’s foreign exchange reserves reached a level of US$ 487.2 billion on March 6, 2020 – an increase of US$ 74.4 billion over their end-March 2019 level.

- Targeted towards achieving CPI of 4% with a bandwidth of +/- 2%, while supporting growth.

- Liquidity measures will ease financial stress in the system, provide relief to borrowers and also ease large sell-off pressures in the financial markets along with free credit flowing by banks.

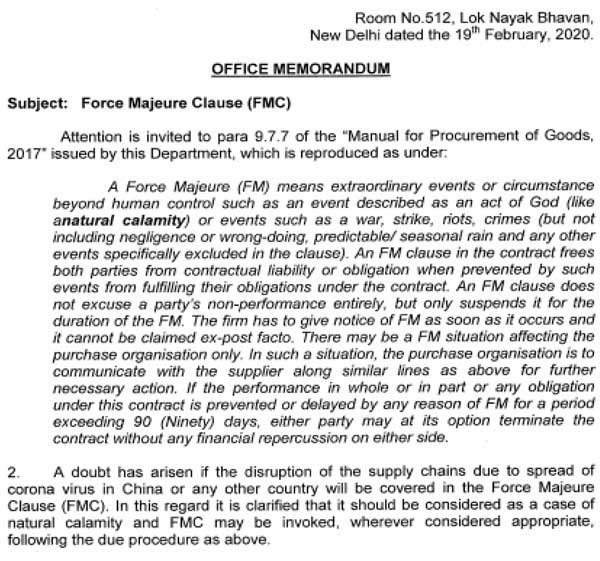

Office Memorandum on Force Majeure Clause

Office Memorandum No.F. 18/4/2020-PPD, dated 19/02/2020 issued by Ministry of Finance, Department of Expenditure, Procurement Policy Division, Government of India, regarding Force Majeure Clause (FMC).

This may also be opted in terms of respective contracts between parties.

Finance Minister announces Rs 1.70 Lakh Crore relief package under Pradhan Mantri Garib Kalyan Yojana for the poor to help them fight the battle against Corona Virus 26 -3-2020

Key Announcements

- Insurance cover of Rs 50 Lakh per health worker fighting COVID-19 to be provided under Insurance Scheme

- 80 crore poor people will to get 5 kg wheat or rice and 1 kg of preferred pulses for free every month for the next three months

- 20 crore women Jan Dhan account holders to get Rs 500 per month for next three months

- Increase in MNREGA wage to Rs 202 a day from Rs 182 to benefit 13.62 crore families

- An ex-gratia of Rs 1,000 to 3 crore poor senior citizen, poor widows and poor disabled

- Government to front-load Rs 2,000 paid to farmers in first week of April under existing PM Kisan Yojana to benefit 8.7 crore farmers

- Central Government has given orders to State Governments to use Building and Construction Workers Welfare Fund to provide relief to Construction Workers

43 Key Highlights

fre gas cylinders for thee months.